Accounting for hardware-as-a-service (HaaS): the 3 standards to know

by Zachary Kimball on August 31, 2023

If you’re on the finance team at a hardware-as-a-service (HaaS) company, you probably know the three key accounting requirements you need to pay attention to: leases (ASC 842), revenue (ASC 606), and assets (ASC 360).1 While none of these is rocket science, each has its own complexities and is a lot to consider—especially when taken together.2

We field questions about these standards regularly from businesses focused on standardizing their hardware financial operations. Here’s a high-level overview of each standard, and why each is so important to HaaS finance teams.

Lease analysis under ASC 842

For a hardware-based solution taking payments over time, HaaS companies should at minimum be doing an embedded lease analysis under ASC 842. Business goals should be driving decisions. If 842 is only being considered after contracts are signed, that’s a problem. Finance and Accounting should determine the desired revenue outcome and use that as a guide to work together with Sales and Legal when structuring HaaS contracts.

ASC 842 is significantly more complex than its predecessor ASC 840. The goal is financial transparency to give investors a more accurate depiction of performance by reflecting leases on the balance sheet and income statement. This works for public companies with significant resources, but is a challenge for smaller and midmarket companies that cannot—or do not wish to—invest the amount of analysis required to follow the guidance correctly.

For HaaS finance leaders, you have to understand the basics to get your job done as simply as possible. This first means an embedded lease analysis. Do you have a lease in your contract? How much of your contract is considered a lease? What kind of lease? It’s common to find leases embedded in HaaS agreements because a typical HaaS contract involves many components: hardware, software, service, warranties, and so on.

The answers to these questions have serious implications—both for recognizing revenue (whether you have to look to the ASC 606 revenue standard) and for keeping assets on your books (whether you have the opportunity to depreciate them under ASC 360):

- Full lease. If your 842 assessment establishes that the whole contract is a lease, revenue is recognized under 842. You won't need 606.

- Embedded lease. If your 842 assessment establishes that a portion of the contract is a lease, revenue for that portion (the embedded lease) is recognized under 842. For the remainder, look to 606.

- No lease. If your 842 assessment establishes that you don't have a lease at all, 842 is irrelevant. All of your revenue will be recognized under 606.

If you’re building a HaaS model and want recurring revenue treatment, ideally you would avoid lease treatment entirely. This is unlikely. It is more likely you’ll be able to get operating lease treatment. But this is not a foregone conclusion and contracts must be handled carefully.

The lease accounting standard recognizes three categories of lease: direct financing leases, sales type leases, and operating leases.

An operating lease is the most desirable type of lease for a HaaS company, because operating leases generally allow recurring-revenue treatment over the life of the contract. Operating leases allow the customer use of an asset without transferring ownership. If you’re offering a HaaS model and want to maximize the valuation of the business, this is the ideal lease model.3

Both direct financing leases and sales type leases are generally less attractive for HaaS companies because there is little or no meaningful recurring revenue for the hardware. In both types of lease, revenue is recognized up front and the asset is derecognized. These capital leases allow the lessee to benefit as if it owns the hardware (e.g., claiming depreciation) while the lessor finances the leased asset. Capital leases are essentially sales contracts with a delayed purchase—asset title transfers at the end of the lease. Depending on whether a capital lease is sales-type or direct financing, a HaaS company must account for profits differently.

Revenue recognition under ASC 606

Based on the embedded lease analysis, all or part of your hardware revenue may be recognized under ASC 842 and the remainder recognized under ASC 606. The 606 standard provides guidance for how to treat revenue through a framework for ongoing customer contracts. While the guidance has little impact on hardware companies operating under a capex sales model, its impact is significant for HaaS companies. With subscription models where customers receive benefits over time, the associated revenue for the seller must also be spread out over time, even if the payment was made up front.

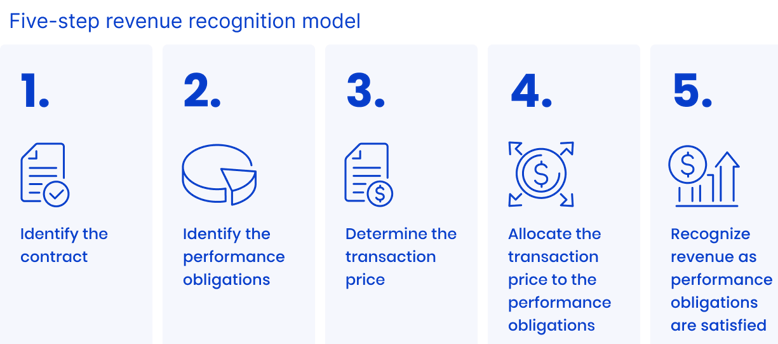

The FASB created a five-step model that companies apply when determining the amount and timing of revenue recognition:

- Identify the contract

- Identify performance obligations

- Determine the transaction price

- Allocate transaction price to performance obligations

- Recognize revenue as performance obligations are satisfied

Although the entire standard is complicated, steps 1 and 3 are most straightforward. The complex steps—particularly for HaaS companies—are 2, 4, and 5:

- Identifying the performance obligations (Step 2). Almost all hardware-as-a-service deals are multi-part contracts—consisting of hardware, software, accessories, consumables, delivery, installation, training, maintenance, warranties, and more. Finance teams need to break down and identify the performance obligations integral to each part of the agreement.

- Allocating the transaction price to performance obligations (Step 4). Finance teams at HaaS companies need to pay special attention when it comes to allocating the transaction price. If your background is in software, allocation may be new to you: software contracts are often simpler. But for a HaaS company: what portion of revenue is attributable to hardware? To software? To support and maintenance?

- Recognizing revenue as performance obligations are satisfied (Step 5). Recognition triggers are likely to be different than the billing schedule (e.g., you can’t recognize a shipping fee until the asset is shipped; an installation fee until installation; or a software fee until deployment). Because real-world asset events are intimately tied to revenue recognition decisions in HaaS, no other business model is nearly as complex.

HaaS finance leaders have to decide how to appropriately measure the progress and fulfillment of a performance obligation and recognize revenue accordingly. HaaS contracts usually mean milestone-based recognition, wherein asset events trigger recognition. With assets out in the real world, this is almost always a manual process rather than an integrated one. Connecting asset information to revenue recognition can be done with systems that integrate asset tracking, billing management, and accounting automation. These are also critical to streamline your hardware subscription billing.

Asset accounting under ASC 360

While ASC 842 provides guidance on how to treat contracted assets, and ASC 606 provides guidance for how to treat contract revenue, ASC 360 provides guidance for how to treat asset cost. The latter guidance matters more for HaaS businesses than others because a large part of finished goods inventory (FGI) can move over to fixed assets as part of new customer contracts, depending on the hardware business model. This applies for companies building their own assets in house and those using a contract manufacturer.

Legacy business models on capex and businesses selling on capital leases have a one-shot process—recognize revenue and cost in the sale period. For these businesses, there’s nothing to depreciate. The difference between a cost of goods (COGS) allocation and an operating expense is a minor debate about gross vs net margin in the sale period.

But for a HaaS business with operating leases or non-lease contracts, the primary cost element affecting gross margin comes from hardware depreciation spread over a period of years. Meanwhile, G&A expense still hits in the current period. So allocation decisions between COGS and operating expense can alter a company’s margin for years! This is why cost accounting for assets under ASC 360 is particularly essential for HaaS.

Your finance team should capitalize the costs to acquire, produce, or improve long-term assets and make the hardware fully ready for its intended use. This means tracking and including the following in depreciation:

- Bill of materials (BOM) costs

- Direct labor costs

- Allocated indirect costs

- Freight costs

- Installation costs

- Tax costs

- Interest costs

1. As a reminder, ASC is “Accounting Standards Codification.” These are the standard guidance for U.S. Generally Accepted Accounting Principles (GAAP). The ASC standards are maintained by the Financial Accounting Standards Board (FASB)

2. Some might argue that the new ASC 842 and ASC 606 guidelines ARE in fact “rocket science” compared to the old ASC 840 and ASC 605 guidance!

3. The difference can be staggering. While a recurring-revenue business with $100M in ARR might be valued at $1B (e.g., using 10x ARR as a rough estimate), the same business with $100M in non-recurring revenue and 40% EBITDA margins might be valued at $200M (e.g., using 5x EBITDA as a rough estimate). So shifting from non-recurring to recurring revenue models allows the same company to increase valuation five times over!

- HaaS (78)

- hardware as a service (77)

- haas100 (43)

- business model (10)

- billing (7)

- contract (4)

- equipment (4)

- RaaS (3)

- accounting (3)

- asset management (3)

- financing (3)

- operations (3)

- MSP (2)

- legal (2)

- managed service provider (2)

- revenue (2)

- robotics (2)

- robots-as-a-service (2)

- DaaS (1)

- MaaS (1)

- actions (1)

- assets (1)

- business model examples (1)

- device-as-a-service (1)

- eaas (1)

- equipment-as-a-service (1)

- finance (1)

- hardware financing (1)

- machine-as-a-service (1)

- metrics (1)

- pricing (1)

- product update (1)

- sales tax (1)

- solution definition (1)

- tax (1)

- February 2026 (1)

- January 2026 (3)

- December 2025 (1)

- November 2025 (2)

- October 2025 (2)

- September 2025 (2)

- August 2025 (3)

- July 2025 (3)

- June 2025 (2)

- May 2025 (2)

- April 2025 (2)

- March 2025 (4)

- February 2025 (4)

- January 2025 (3)

- December 2024 (3)

- November 2024 (2)

- October 2024 (2)

- September 2024 (3)

- August 2024 (2)

- July 2024 (2)

- June 2024 (2)

- May 2024 (1)

- April 2024 (2)

- February 2024 (3)

- January 2024 (3)

- December 2023 (3)

- November 2023 (3)

- October 2023 (3)

- September 2023 (1)

- August 2023 (2)

- July 2023 (2)

- June 2023 (1)

- May 2023 (1)

- April 2023 (2)

- March 2023 (1)

- February 2023 (1)

%20asset%20COGS%20breakdown%20by%20cost%20category.png?width=761&height=395&name=Hardfin%20example%20hardware%20as%20a%20service%20(HaaS)%20asset%20COGS%20breakdown%20by%20cost%20category.png)