Why is hardware-as-a-service (HaaS) complicated for the finance org?

by Zachary Kimball on July 11, 2023

Finance leaders at hardware-as-a-service (HaaS) companies have complicated jobs, because the business effectively has three separate finance teams. This is partly because the hardware-as-a-service model is new. Whether for day-to-day financial operations or overseeing the whole team’s responsibilities, HaaS typically means venturing into new territory because hardware creates complexity across the company.

HaaS is gaining popularity just like the software industry moved to software-as-a-service (SaaS). The model has parallels to SaaS, with some iterations to the business model. One of the most complex is the three-part role that hardware finance teams must manage HaaS. A finance leader at a HaaS company has to juggle all three pillars of hardware financial operations.

- Hardware tracking: When it comes to the actual assets, HaaS finance teams need to coordinate components, finished goods, shipping, deployment, fixed asset tracking, servicing, COGS calculations, depreciation, auditing a distributed asset base, and more. So finance needs an understanding of how this works for the organization.

- Leasing and financing: Finance has to understand the company’s leasing structure and its implications for revenue recognition. They have to deal with an entire capital provision infrastructure that’s likely foreign to them if they only have backgrounds in traditional hardware. And they have to manage the interest rate risk implicit in the company’s pricing model.

- Subscription management: Finance has to figure out how to routinely invoice many customers in many locations for many assets—all of which may be priced differently with balances due at different milestones.

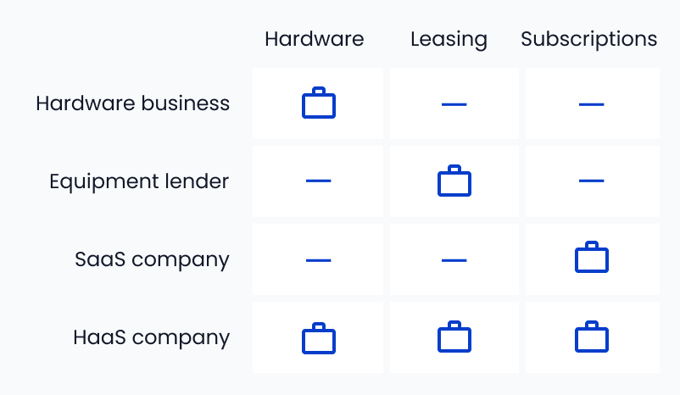

In other words, finance leaders are running three finance teams in one. It’s an unsolvable equation without support systems in place. This is very different than a classic hardware business, an equipment lender, or a SaaS company—each of which only one set of problems to worry about.

Finance team #1: Hardware tracking

A hard asset is foundational to a HaaS offering. Whether building in-house from parts or using a contract manufacturer, hardware is complex. Companies have to coordinate sourcing of components, finished goods inventory (FGI), shipping and fulfillment, installation and deployment, fixed asset tracking, as well as ongoing servicing.

Layer on calculations for cost of goods sold (COGS)—including the bill of materials (BOM), labor, taxes, interest, and more—as part of managing asset accounting for HaaS under ASC 360. Then work through the audit process for your distributed asset base. The accounting team has a big job here!

The complexity of an entire hardware company sits behind the front counter of your business. While ongoing costing and sourcing of BOM can be managed under a finance team in a traditional capex hardware business, no CEO is going to double the size of a HaaS company’s finance team just to deal with the hardware side of the business.

Finance team #2: Leasing and financing

Whether your business is considered leasing or not, offering a hardware-based solution with payments over time requires at least an embedded lease analysis under ASC 842. It’s crucial for finance leaders—and their teams—to understand what the company’s contract structure implies for lease treatment and the implications for revenue recognition.

And HaaS companies have to source capital to fund the full cost of goods in advance, even while they’re accepting smaller customer payments over time. This means there's a clear need for capital infrastructure in a HaaS business that is much harder to manage than in a traditional hardware sales model. This also means that HaaS companies are subject to interest-rate risk, because they’re pricing the difference between their capital supply and their customer contracts. What’s more, taking payments over time for hardware that is funded upfront means profits are subject to customer-credit risk. These unique considerations related to hardware leasing don’t exist in software: if a customer stops paying, SaaS companies simply turn off the license.

So HaaS finance teams are required to manage both upfront and ongoing risks. Things gets even more complicated when incorporating pay-per-use or pay-for-performance models. Not only is there financing complexity and risk management, but there’ is also pricing variability to model—meaning the team must consider performance-based risk as well.

Finance team #3: Subscription management

A HaaS subscription is a series of real-world asset activities that must be interlinked with one-time and recurring billing events. First, the finance team has to figure out the “normal” invoicing challenges—how to invoice a range of customers across a range of locations. There may be down payments or prepayments. Invoicing may be one-time, or may require monthly, quarterly, or annual payments.

Then the finance team has to resolve HaaS-specific invoicing challenges: How to tie hardware activity to subscription activity? This process is called hardware finance reconciliation (or a “hardfin recon”):

- Assets may have been newly shipped, delivered, or deployed. Will invoices start on the date of deployment, or at another milestone?

- Assets may not be functioning as intended. Will those assets be billed?

- Assets may have usage data that implicate billing. How are metrics calculated to generate invoices, and how are those data shared with customers?

- Amounts may be constant or variable. How will line items be adjusted?

- Sales taxes will vary by line item and jurisdiction, and on the leased status of each asset. What method is used to calculate tax liability?

- Recurring charges may start at multiple times and need to be consolidated. Which invoices can be combined or must be split?

Finance teams also have to measure and model metrics such as MRR and ARR that are native to SaaS companies but often unfamiliar to hardware businesses. So finance leaders need to pay close attention to revenue recognition under ASC 606. Rev rec may be affected by the leasing determination, and asset events may trigger recognition differently than billing. For example, asset fees may be billed on shipment but not recognized until installation. No other business model comes close to this level of complexity—it’s why SaaS billing software is inadequate for modern hardware companies.

“We take initial payment at contract signing. We also bill a percentage upon delivery, another percentage upon customer training, and a final amount once the customer accepts certain performance metrics. Once an asset is deployed, we bill for the hardware and separately for the subscription. Customer deposits need to be applied across both the hardware and the software at those milestones. The whole thing is a billing and accounting nightmare.”

Solutions to manage hardware financial operations

Historically, these were three independent businesses—hardware manufacturer, equipment finance firm, SaaS company. With HaaS models exploding in popularity, we’re seeing more finance leaders wrestle with the trio all at once.

The truth is most finance leaders only have knowledge and experience in one or two of these areas—depending on whether they came from SaaS companies or traditional hardware companies. So by no fault of their own, finance leaders are actively learning a large part of the company’s financial operations! These leaders need context and confidence; there are problems to solve and they need operational support.

Unfortunately, solutions often include over-hiring employees, over-spending on consultants, or under-delivering on reporting, which creates risk. Until recently, it hadn’t been possible to run a HaaS model on existing software. Hardfin was developed specifically to solve this need. Now finance leaders can take control of their hardware financial operations and set up one team to execute the work of three. From asset tracking to billing management to accounting automation, the Hardfin platform provides a unified reporting layer for hardware-as-a-service.

“For the leasing model to work, we had to have a way of accumulating the data so customers could see how trucks are performing. We looked at setting it up; we looked at custom software to do that; then we discovered Hardfin and realized, ‘They are already doing it.’ So why reinvent the wheel if Hardfin can collect data on hardware activity, give customers access to a portal where they can see asset performance, and automate billing for that activity. We can see our entire fleet of trucks; we have the billing data and truck performance at our fingertips. That's exactly what we're looking for.”

| As HaaS business models evolve, technology is evolving to support it. That’s where Hardfin comes in: manage, operate, and report on your hardware, regardless of the complexity of your business model. | ||

- HaaS (78)

- hardware as a service (77)

- haas100 (43)

- business model (10)

- billing (7)

- contract (4)

- equipment (4)

- RaaS (3)

- accounting (3)

- asset management (3)

- financing (3)

- operations (3)

- MSP (2)

- legal (2)

- managed service provider (2)

- revenue (2)

- robotics (2)

- robots-as-a-service (2)

- DaaS (1)

- MaaS (1)

- actions (1)

- assets (1)

- business model examples (1)

- device-as-a-service (1)

- eaas (1)

- equipment-as-a-service (1)

- finance (1)

- hardware financing (1)

- machine-as-a-service (1)

- metrics (1)

- pricing (1)

- product update (1)

- sales tax (1)

- solution definition (1)

- tax (1)

- February 2026 (1)

- January 2026 (3)

- December 2025 (1)

- November 2025 (2)

- October 2025 (2)

- September 2025 (2)

- August 2025 (3)

- July 2025 (3)

- June 2025 (2)

- May 2025 (2)

- April 2025 (2)

- March 2025 (4)

- February 2025 (4)

- January 2025 (3)

- December 2024 (3)

- November 2024 (2)

- October 2024 (2)

- September 2024 (3)

- August 2024 (2)

- July 2024 (2)

- June 2024 (2)

- May 2024 (1)

- April 2024 (2)

- February 2024 (3)

- January 2024 (3)

- December 2023 (3)

- November 2023 (3)

- October 2023 (3)

- September 2023 (1)

- August 2023 (2)

- July 2023 (2)

- June 2023 (1)

- May 2023 (1)

- April 2023 (2)

- March 2023 (1)

- February 2023 (1)