Examples of successful robots-as-a-service (RaaS) models

by Zachary Kimball on July 31, 2023

The robots-as-a-service (RaaS) market is growing at a rapid pace, widely measured in the billions of dollars and growing rapidly at annual rates of 15–20%. This market boom is being driven by the growing demand for automation across industries. Businesses across industries—healthcare, hospitality, logistics, retail, fulfillment, manufacturing, infrastructure, agriculture, and more—want to automate repetitive and tedious tasks.

Companies need to improve productivity, efficiency, consistency, and safety. Labor shortages and increased labor costs drive a rush to remain competitive. RaaS removes the barrier to entry. It provides a flexible and affordable way for companies to access advanced automation without significant up-front investments.

What is robots-as-a-service (RaaS)?

Under the RaaS business model, a robotics company doesn’t sell robots outright. Instead, it leases them out to customers for short-term or long-term use under a subscription model. Rather than paying for the robot (and its accompanying software and services), customers pay for the use it delivers. This is similar to the more general definition of hardware-as-a-service (HaaS).

A RaaS company might offer both time-based subscriptions (in which customers pay by the week or the month) and task-based subscriptions (in which customers pay per transaction the robot performs). Both types offer a new flexibility, since customers only pay for the time they require the services, or the tasks they need completed. RaaS allows robotics customers a pay-as-you-go option and gives them a full-service experience, making adoption more manageable. Providers see more consistent revenue and greater returns over the lifetime of the robot, along with greater visibility into predicting revenue and more accurate supply planning. RaaS is still relatively new, but customers are growing increasingly receptive when the HaaS model makes sense for the use case.

Why is RaaS happening now?

The adoption of RaaS is being driven by more than increased demand for automation. In the traditional model, a buyer could support a piece of equipment on their own. As advancements in AI and machine learning have expanded robotic capabilities, the specialization of robot software means that customers are no longer capable of supporting, maintaining, or improving the solution. But now providers have the ability to make those ongoing investments remotely through cloud computing, so providers can monitor and manage robots themselves. This has led to an explosion of RaaS companies.

A necessary part of this model is that RaaS providers develop an end-to-end solution for the customer, including software and any additional service with the robot. Software may allow users to monitor the robots (whether onsite or remotely), manage their movements if necessary, and coordinate multiple robots simultaneously. Services may include customer support, maintenance and repairs, software and hardware updates, and more. It is critical for providers to define HaaS solutions that are effective based around the core product offering.

Developing industry-specific RaaS solutions: a simple example

Consider the automated forklift as an example of this transition to RaaS. Historically, forklifts have been sold outright—a traditional forklift might cost $25,000 to $50,000, and the buyer of that forklift has to operate, maintain, and repair it. But as more automation is added to the equipment, a RaaS model naturally emerges. A robot company may purchase a high-end forklift for $50,000, in addition to $30,000 of sophisticated components—cameras, sensors, and LiDAR, for example—and fit out the machine with integrative technologies that allow for real-time location or speed control.

Now that previously “dumb” forklift is a “smart” piece of hardware, controlled by a complex software layer, with digital additions that substantially improve operations and maximize customer benefit. The automated forklift company has two options:

- sell the smart forklift outright for $160,000 and charge additional fees along with it (software subscription, maintenance plan, support contract, etc) for a committed period of time such as 36 months

- offer the smart forklift on a complete RaaS subscription—perhaps $7,000 per month—after which the customer has the option to return the forklift to the service provider

In the latter option, a customer will have access to the forklift technology—and its full ecosystem as the technology evolves. The robotics company will offer their software, upgrade analytics in the cloud, and even replenish consumables on a subscription basis. A technician working for a logistics provider, for example, knows how to service a traditional forklift; but does not have the skills or training required to maintain an integrated autonomous forklift. So the RaaS option is much more appealing for a buyer who does not have the in-house resources to maintain an autonomous forklift with state-of-the-art technologies built into it.

Real examples across RaaS

Given that most RaaS technologies are proprietary, a buyer needs to continuously engage the manufacturer regardless of the purchase model, so the manufacturer becomes a core partner to the buyer’s business. In these circumstances, a subscription model makes much more sense for both parties. Below are more examples of companies and their robotics solutions for which RaaS is working as a business model.

Landscaping robots: commercial lawnmowing as RaaS

Scythe Robotics developed a groundbreaking autonomous electric lawnmower that supports commercial lawnmowing teams to complete their jobs better. The lawnmower can mow all day on a single charge, with an array of sensors that allow it to operate safely in dynamic environments. The M.52 mower identifies objects such as humans, animals, cars, and trees in order to navigate and complete the task successfully.

Scythe’s business model relies on a usage-based RaaS model that bills by the acre depending on how much the mowers get done. "With a usage-based model, Scythe is able to align incentives better with our customers,” says Jack Morrison, CEO of Scythe. “Landscapers want one thing: a mower that can reliably and efficiently mow as much as possible. On a pay-per-use model, customers create an ongoing partnership that ensures we all have exactly the same goal. And now Scythe has designed the fastest, most efficient, and most durable machine possible to ensure we deliver on that partnership.”

This pay-per-use model also avoids a notorious reputational risk in high-impact commercial equipment like lawnmowers: legacy manufacturers have an incentive to minimize costs to the point where their products live just long enough for the warranty to expire! With RaaS, Scythe’s incentives are much better aligned to their customers, and they have created an ongoing partnership with their contractor base.

Logistics robots: autonomous forklifts as RaaS

Third Wave Automation produces high-reach autonomous forklifts that can handle any payload or pallet from the warehouse floor to the rack, without requiring warehouses to change infrastructure or operations. The company outfits its forklifts for obstacle avoidance and dynamic navigation—so the robot isn’t locked into predetermined paths or directions. The robots easily integrate into existing warehouse workflows, enabling operators (who can now manage the forklift remotely) to increase throughput while improving worker safety.

Third Wave has taken a shared autonomy approach. Customers have the flexibility to deploy their fleets in four operational modes: fully autonomous, remote operation, remote assist, and fully manual operation. The control paradigm is one of Third Wave’s differentiators, helping them earn a spotlight as one of the best robots of CES 2023. If a robot in autonomous mode detects an issue—a misaligned pallet, for example—it alerts the remote operator to the situation, who can either take local control of the vehicle or resolve the issue and put it back into autonomous operation. Machine learning capabilities allow the robot to respond to edge cases and improve over time.

"At the end of the day, the primary business metric warehouse managers are looking at is how many items they are able to move through their space. When we discuss robotic solutions with them, that is where the conversation starts—can we meet or improve their current flow?" says Andre Sequin, VP of Finance at Third Wave. "From that baseline, we can move into enticing ancillary benefits. A warehouse is always moving and can be a dangerous environment to humans; if you are able to automate a section of your warehouse, you immediately cut out that risk of injury. In addition, forklifts don't get tired, sick, or quit. So, you can start getting into some really compelling calculations—aside from moving pallets, how much additional value am I getting from a RaaS solution?"

Construction robots: crack-sealing automation as RaaS

Robotic Maintenance Vehicles (RMV) builds a robotic sealcoat vehicle that automatically finds and seals cracks in the road. RMV’s product requires only one operator, instead of a conventional crew of four, who is able to stay in the truck’s cab and out of harm’s way on the highway. The CrackPro, which earned RMV the Fanuc America 2022 Innovative System of the Year award, is a Class 7 truck chassis equipped with AI vision that utilizes both high-resolution cameras and lasers to guide its robotic arm. The AI system finds, scans, and measures the pavement cracks, then controls the flow of sealant by communicating crack size with the sealant wand.

The truck’s speed, accuracy, and efficiency levels outperform what the most seasoned crack-sealing crew can do manually. And it can also operate at night, continuing to accurately judge crack depth and sealing cracks during quieter hours. Meanwhile, the driver oversees this on a monitor, which displays a camera feed of the arm. Under its RaaS model, RMV charges per linear foot of crack that their trucks have sealed.

Todd Hendricks, owner of RMV, shares: “That's why it’s so important for the truck’s software to collect data. Instead of paying a million dollars for a truck, customers now have access for a small deposit, roughly the cost of a brand-new manual crack sealing unit. And then we just take a fee per linear foot of crack sealed. So for the cost of a manual crack seal unit, you could get one of these million-dollar automated trucks. And then we just pull the data and invoice the lease.”

Retail robots: inventory management scanning as RaaS

Simbe Robotics’ flagship commercial robot is “Tally,” an AI-powered retail intelligence platform. Tally autonomously collects and analyzes inventory data in retail environments—scanning products on shelves to ensure they’re in stock, in the right location, and priced accurately. The robot and its navigation are powered by computer vision, radio frequency identification (RFID), and machine learning. The suite of sensors allows Tally to operate during store hours without any infrastructure changes to the store.

Through Simbe’s cloud platform, Tally gives retailers real-time recommendations to improve brick-and-mortar operations and maximize customer experience. This includes which shelves are most effective, how products perform in different store locations, and the best time to reorder a product based on sales data. With their RaaS model, Simbe doesn’t sell Tally units outright. Instead, the company offers the hardware free of charge; then retailers pay a monthly fee depending on deployment size, number of SKUs scanned, or which of Tally’s features are actively used.

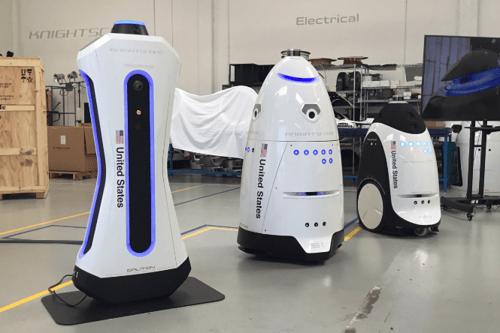

Security robots: police patrol as RaaS

Knightscope is a robotics manufacturer that offers robots to patrol buildings in lieu of traditional security guards. The company calls these autonomous security robots (ASRs). As they patrol, the sentry robots collect data that is fed back into AI algorithms and makes the security system continually better—ultimately benefiting both the manufacturer and the customer.

Subscribers such as police departments or security teams can see an additional cost savings because the system is not relying on human to be in all places at all times. This reduces the need to expand the force, allowing existing officers to do more with less, all while saving time and reducing fatigue.

Knightscope implemented sentry robots with an hourly charge for their robots through a true RaaS subscription model. The RaaS model ensures that security professionals have access to the professionally maintained hardware in the field because Knightscope owns the fleet, and to the most up-to-date software on the Knightscope platform delivered through the cloud.

How does Hardfin fit into robots-as-a-service?

Like the broader HaaS industry, RaaS has changed the payment landscape. While RaaS offers a world of advantages for both robotics providers and buyers, it adds complexity for organizations selling these models because they are more complicated than a traditional hardware sale and more complicated than a traditional software subscription. These models create particular complexity for the finance team because of the way that as-a-service models have to collect data across the org for billing and accounting.

As business models evolve, so does the technology and expertise to support it. Hardfin lets you take control of your hardware financial operations. Easily offer your robots as a subscription. Want to know more? We’d love to chat with you.

- HaaS (79)

- hardware as a service (78)

- haas100 (44)

- business model (10)

- billing (7)

- contract (4)

- equipment (4)

- RaaS (3)

- accounting (3)

- asset management (3)

- financing (3)

- operations (3)

- MSP (2)

- legal (2)

- managed service provider (2)

- revenue (2)

- robotics (2)

- robots-as-a-service (2)

- DaaS (1)

- MaaS (1)

- actions (1)

- assets (1)

- business model examples (1)

- device-as-a-service (1)

- eaas (1)

- equipment-as-a-service (1)

- finance (1)

- hardware financing (1)

- machine-as-a-service (1)

- metrics (1)

- pricing (1)

- product update (1)

- sales tax (1)

- solution definition (1)

- tax (1)

- February 2026 (2)

- January 2026 (3)

- December 2025 (1)

- November 2025 (2)

- October 2025 (2)

- September 2025 (2)

- August 2025 (3)

- July 2025 (3)

- June 2025 (2)

- May 2025 (2)

- April 2025 (2)

- March 2025 (4)

- February 2025 (4)

- January 2025 (3)

- December 2024 (3)

- November 2024 (2)

- October 2024 (2)

- September 2024 (3)

- August 2024 (2)

- July 2024 (2)

- June 2024 (2)

- May 2024 (1)

- April 2024 (2)

- February 2024 (3)

- January 2024 (3)

- December 2023 (3)

- November 2023 (3)

- October 2023 (3)

- September 2023 (1)

- August 2023 (2)

- July 2023 (2)

- June 2023 (1)

- May 2023 (1)

- April 2023 (2)

- March 2023 (1)

- February 2023 (1)

%20Crack%20Sealer.png?width=500&height=334&name=Robotic%20Maintenance%20Vehicle%20(RMV)%20Crack%20Sealer.png)