HaaS 100 (March 2024)

by Zachary Kimball on January 11, 2024

Hardware-as-a-service (HaaS) is gaining momentum across a variety of industries. Many of the early adopters of HaaS are in robotics, offering robots-as-a-service (RaaS) to decrease barriers to entry and improving overall value to customers. Others offer machine-as-a-service (MaaS), device-as-a-service (DaaS), or equipment-as-a-service (EaaS).

Some companies pitch outcomes more than assets, offering data-as-a-service or platform-as-a-service models. From food handling, ocean data, and IoT sensors, to autonomous inventory handling and worksite security, these companies are on the cutting-edge of their fields.

This post is one in a series about modern hardware companies, their business models, and the future of HaaS. For more, see volume 1 and volume 2.

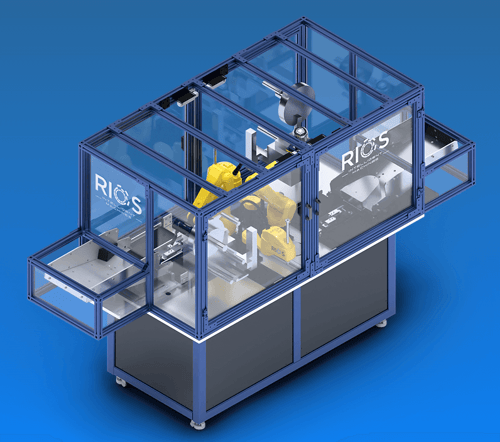

RIOS Intelligent Machines

- Founded date: 2018

- Location: Menlo Park, California

- Employees: ~30

- Industries: wood products, beverage distribution, packaged foods

- Key customers: Ramar Foods, Hit Promotional Products, FANUC, Yamaha

- Website: rios.ai

RIOS provides AI-powered robotics that help manufacturers increase the revenue of their production lines. Their platforms can adapt to production requirement changes and automate processes that previously were only possible through manual labor. RIOS leverages AI-powered vision to monitor operations and increase the labor productivity of workers—taking on complex, dangerous, or monotonous work that is better suited for machines.

RIOS partners with their clients to deliver solutions that help them meet payback thresholds quickly. One approach they offer is a “factory automation-as-a-service” model that includes hardware, software, and comprehensive support. RIOS seeks to democratize access to advanced robotics, empowering manufacturers to harness the transformative potential of intelligent machines without the traditional barriers to entry.

“Our goal is to ensure that every solution we propose meets our client's financial goals and adds substantial value to their operations,” says Michael Batty, VP of Finance at RIOS Intelligent Machines. “It's about understanding their needs, aligning our resources, and delivering results that exceed expectations while respecting their budget constraints."

Sofar Ocean

- Founded date: 2016

- Location: San Francisco, California

- Employees: ~88

- Industries: ocean data

- Key customers: United States Navy, DARPA, WMO, Berge Bulk

- Website: sofarocean.com

Sofar Ocean’s suite of solutions focus on providing greater understanding of the world’s oceans. Their hardware captures a vast amount of ocean data allowing users to make informed choices for sustainable ocean management and conservation.

Their products are offered via a combination of outright purchase for hardware and subscription fees for software and data.

Butlr

- Founded date: 2019

- Location: Burlingame, California

- Employees: ~90

- Industries: IoT sensors

- Key customers: Georgia Pacific, Carrier, Lenovo

- Website: butlr.com

Butlr sells sensors designed to capture temperature changes to identify occupancy changes while maintaining anonymity. The data collected allows users to answer questions like “How many people are in our space vs its capacity?” and “Which days of the week are most popular?”

Butlr’s sensors are available via a few models: hardware sales and software subscriptions, hardware lease and service plan, and an all-in sensing-as-a-service option including hardware, software, and service.

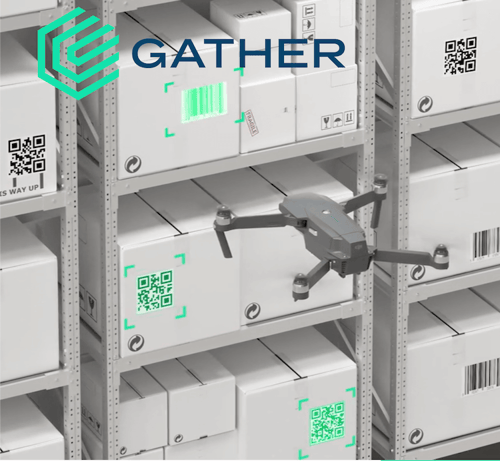

Gather AI

- Founded date: 2018

- Location: Pittsburgh, Pennsylvania

- Employees: ~46

- Industries: warehouse inventory

- Key customers: Bosch, NFI, Barrett Distributions

- Website: gather.ai

Gather AI's software powers off-the-shelf drones to automate inventory monitoring, utilizing drones and software to improve inventory accuracy. The system is designed to identify misplaced inventory, find errors, and improve overall warehouse efficiency. The drones remove the need to use scissor lifts for inventory and can scan 300-900 pallets per hour.

Gather AI offers automated inventory monitoring through a robots-as-a-service (RaaS) model, allowing customers to “pay as you scale”. The pricing includes the drones, software, and ongoing support.

“Our model makes it easy for our customers to get started, they can get up and running in 30 days or less. We utilize their existing labels, don’t require infrastructure changes, and the RaaS model removes the large upfront investment required by other systems. Operators are feeling the need to digitize their warehouses and we enable them to do that as quickly as possible,” says Sankalp Arora, CEO and Co-Founder at Gather AI.

LiveView Technologies (LVT)

- Founded date: 2005

- Location: American Fork, Utah

- Employees: ~443

- Industries: security

- Key customers: Bass Pro Shops, Philadelphia Phillies, Enel Group, Thanksgiving Point

- Website: lvt.com

LiveView Technologies specializes in remote surveillance and security solutions. They focus on providing real-time video monitoring, analytics, and management for various industries, including construction, mining, oil and gas, utilities, and more. Their security unit is portable, able to be rapidly deployed, and can be customized to customer needs.

LVT offers their security system on a hardware-as-a-service (HaaS) model charging a rate of $4/hr. Since the unit is mobile and can be set up quickly, customers can easily move the unit to locations where they most need it, only paying for usage.

- HaaS (79)

- hardware as a service (78)

- haas100 (44)

- business model (10)

- billing (7)

- contract (4)

- equipment (4)

- RaaS (3)

- accounting (3)

- asset management (3)

- financing (3)

- operations (3)

- MSP (2)

- legal (2)

- managed service provider (2)

- revenue (2)

- robotics (2)

- robots-as-a-service (2)

- DaaS (1)

- MaaS (1)

- actions (1)

- assets (1)

- business model examples (1)

- device-as-a-service (1)

- eaas (1)

- equipment-as-a-service (1)

- finance (1)

- hardware financing (1)

- machine-as-a-service (1)

- metrics (1)

- pricing (1)

- product update (1)

- sales tax (1)

- solution definition (1)

- tax (1)

- February 2026 (2)

- January 2026 (3)

- December 2025 (1)

- November 2025 (2)

- October 2025 (2)

- September 2025 (2)

- August 2025 (3)

- July 2025 (3)

- June 2025 (2)

- May 2025 (2)

- April 2025 (2)

- March 2025 (4)

- February 2025 (4)

- January 2025 (3)

- December 2024 (3)

- November 2024 (2)

- October 2024 (2)

- September 2024 (3)

- August 2024 (2)

- July 2024 (2)

- June 2024 (2)

- May 2024 (1)

- April 2024 (2)

- February 2024 (3)

- January 2024 (3)

- December 2023 (3)

- November 2023 (3)

- October 2023 (3)

- September 2023 (1)

- August 2023 (2)

- July 2023 (2)

- June 2023 (1)

- May 2023 (1)

- April 2023 (2)

- March 2023 (1)

- February 2023 (1)