Developing hardware-as-a-service (HaaS) pricing plans

by Zachary Kimball on October 31, 2023

Sales and finance leaders at hardware companies often wonder about hardware-as-a-service (HaaS) pricing. Sometimes pricing feels like pulling a number from thin air. Hardfin has seen a lot of different approaches to the question “how do we price our offering?”

Some businesses launch with low pricing in order to land early customers. Many hardware companies overcomplicate pricing with a matrix rate sheet. Others simply sell hardware outright to avoid the complexity of modern hardware business models.

Pricing HaaS solutions: the big question for Finance and Sales

Developing a HaaS pricing plan should be a collaborative effort between Finance and Sales. Finance needs to examine BOM costs, keep a close eye on unit economics, and manage deal margin. Sales needs to review current market offerings, consider their unique solution, and test the pricing plan with buyers.

A pricing exercise should come after designing an effective HaaS solution and structuring your offer through bundling. If you haven’t strategically designed and structured your offering, that’s step one. First determine the components that are a part of your solution, then identify how best to package them together.

Once ready, there are four steps to develop the appropriate pricing plan for your solution:

- Examine your costs (Finance)

- Set your margin target (Finance)

- Review the market (Sales)

- Test with buyers (Sales)

Take each step in turn.

1. Examine your costs (Finance)

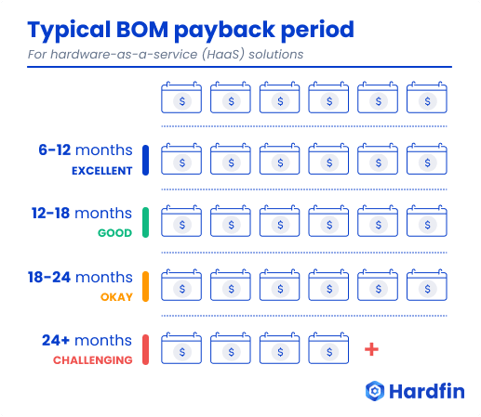

Companies should aim for a 12–18 month bill of materials (BOM) payback period or better. BOM payback period (BPP) is a critical metric for HaaS businesses; it refers to the number of months before recurring customer payments cover the upfront cost of your bill of materials.1

For example, if it costs $150,000 to build a piece of hardware and customers pay $10,000/month for the solution, BPP is 15 months—the point at which asset costs are roughly covered by customer payments. BPP is deeply intertwined with unit economics and crucial to understand for scalability.

So what’s a good BPP? 6–24 months is a reasonable range:

- Excellent: 6–12 months. A best-in-class BPP is 6–12 months for a solution with low-cost hardware, a strong software layer, and a complementary service package.

- Solid: 12–18 months. We often see 12–18 month BPP for proprietary HaaS models that are working well.

- Okay: 18–24 months. Companies with an 18–24 month BPP can make it work—but margins will suffer.

- Challenging: 24+ months. Beyond 24 months, it’s difficult to get financing and tough to make the interest math work.

With a BPP up to 24 months, HaaS companies can float the cost on the balance sheet, and debt is more accessible. Major exceptions to these benchmarks are long-term (3+ year) and government (e.g., defense) contracts, where a longer BPP can still be profitable.

Key questions to consider for HaaS finance leaders about HaaS pricing:

- What would your proposed pricing package mean for your BPP?

- Can your financing model you’re considering support this BPP structure?

2. Set your margin target (Finance)

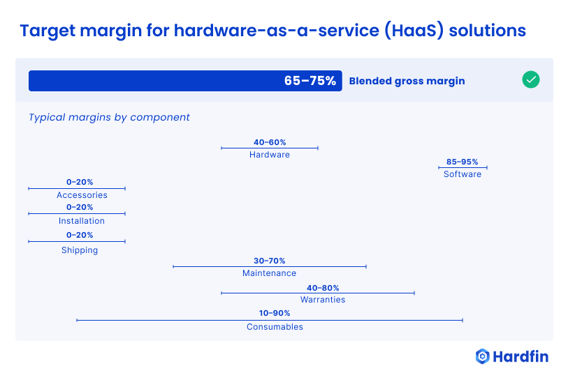

Typical margins in HaaS depend on why your solution is hardware-as-a-service (HaaS) and on when HaaS makes sense in your industry. Broad industry trends suggest a 65-75% blended gross margin is a good target for most B2B HaaS businesses offering a full solution.

The bulk of the solution will be in two core components:

- Hardware: 40–60% gross margin

- Software: 85–95% gross margin

A few components typically have very slim margins:

- Accessories: 0–20% gross margin

- Installation: 0–20% gross margin

- Shipping: 0–20% gross margin

Three optional components have margins that vary widely:

- Maintenance and repair: 30–70% gross margin (depending on overhead)

- Warranty and service plans: 40–80% gross margin (depending on reliability)

- Consumables: 10–90% gross margin (depending on proprietary media)

Key questions to consider for HaaS finance leaders about HaaS pricing:

- Evaluating your HaaS solution—and your bundled package—to gauge your blended margin, where do you fall relative to benchmarks?

- Considering your investment or financing expectations, how do these margins affect your cash flow needs?

3. Review the market (Sales)

Pricing for hardware-as-a-service (HaaS) isn’t a linear process and should be iterative. But because hardware has meaningful physical costs, starting with a brief analysis of cost and margin is important to set guardrails for the market study. Once Finance has examined costs and defined margins, Sales jumps in for its role in the collaboration.

Start with benchmarks. In general, more expensive pieces of equipment are a bigger part of the full package price. So where a HaaS package might be 10x the cost of a $100 sensor ($1,000 total), software makes up 90% of the package price. On the other hand, a HaaS package might only be 2x the cost of a $500,000 truck ($1,000,000 total), where software makes up 50% of the package price. Some general benchmarks for HaaS package pricing:

| Benchmark product | Package price | Software portion |

| 🖲️ $100 sensor | 10x cost ($1,000) | $900 (~90%) |

| 💻 $1,000 electronics | 5x cost ($5,000) | $4,000 (~80%) |

| 🦾 $10,000 machine | 4x cost ($40,000) | $30,000 (~75%) |

| 🤖 $100,000 robot | 3x cost ($300,000) | $200,000 (~67%) |

| 🛻 $500,000 truck | 2x cost ($1,000,000) | $500,000 (~50%) |

| 🖨️ $1,000,000 3D printer | 1.25x cost ($1,250,000) | $250,000 (~20%) |

This is a simplification—there are other charges for solutions such as shipping, maintenance, and accessories. But the above hardware/software breakdown is fairly consistent in high-performing HaaS companies.

Sales should have an immediate sense of the market around your proposed pricing. If your solution is similar to what buyers are used to, your pricing structure should be similar. If your solution is different (and the difference is clear), it will be easier to have prices that are different. Ensure your feedback loop is fast so you can iterate.

For market discovery, one of the best sources is companies in adjacent markets that are relevant but non-competitive. Reach out and ask how they price. If you’re structuring usage-based pricing for your sentry robot, how did they structure pay-per-use pricing for their robotic lawnmower? Other leaders are often happy to take 20 minutes to help.

Key questions to consider for HaaS sales leaders about HaaS pricing:

- What is the market used to paying for prior offerings?

- What are you hearing that prospects are seeing with competitors?

4. Test with buyers (Sales)

Finally, make sure your pricing package simplifies your solution for your buyers. If pricing is too complex, it will be harder for prospects to understand and agree. We often see contracts that verge on overly complex—and that doesn’t even consider how to manage complex HaaS billing.

A HaaS organization might offer multiple sales models—legacy, hybrid, or subscription—and this complexity is essential to manage. In the earliest days, your organization might test multiple pricing models for each mode of selling. But as you scale, settling on one pricing plan for each model is the best strategy. Don’t offer three full subscription pricing models and three hybrid pricing models. It's too much for customers and it's too much for the sales team. It also introduces increased complexity for the finance org to execute.

Maybe your full HaaS subscription is $10k/mo, while your hybrid model sells the asset outright for $150k and charges $3k/mo for software. For prospective customers, this should be a simple comparison of subscription-versus-hybrid.

Key questions to consider for HaaS sales leaders about HaaS pricing:

- If you tell existing customers what you’re thinking about charging for a new product, what are they comfortable with?

- Can you explain your pricing to a customer in 30 seconds?

How Hardfin can help

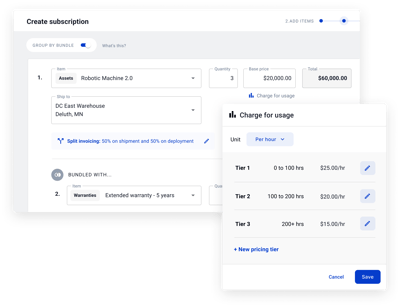

At Hardfin, our experts can support questions you might have about your own hardware-as-a-service (HaaS) pricing plan. Once your pricing structure is in place, we provide a suite of tools to implement any type of HaaS business model.

Hardfin lets you take charge of your hardware financial operations. Get a unified view of your business from the top level to the details so you can go from contract to revenue faster.

1. BPP can be made more precise by using the HaaS asset's fully-loaded cost of goods sold (COGS) instead of just bill of materials.

- HaaS (79)

- hardware as a service (78)

- haas100 (44)

- business model (10)

- billing (7)

- contract (4)

- equipment (4)

- RaaS (3)

- accounting (3)

- asset management (3)

- financing (3)

- operations (3)

- MSP (2)

- legal (2)

- managed service provider (2)

- revenue (2)

- robotics (2)

- robots-as-a-service (2)

- DaaS (1)

- MaaS (1)

- actions (1)

- assets (1)

- business model examples (1)

- device-as-a-service (1)

- eaas (1)

- equipment-as-a-service (1)

- finance (1)

- hardware financing (1)

- machine-as-a-service (1)

- metrics (1)

- pricing (1)

- product update (1)

- sales tax (1)

- solution definition (1)

- tax (1)

- February 2026 (2)

- January 2026 (3)

- December 2025 (1)

- November 2025 (2)

- October 2025 (2)

- September 2025 (2)

- August 2025 (3)

- July 2025 (3)

- June 2025 (2)

- May 2025 (2)

- April 2025 (2)

- March 2025 (4)

- February 2025 (4)

- January 2025 (3)

- December 2024 (3)

- November 2024 (2)

- October 2024 (2)

- September 2024 (3)

- August 2024 (2)

- July 2024 (2)

- June 2024 (2)

- May 2024 (1)

- April 2024 (2)

- February 2024 (3)

- January 2024 (3)

- December 2023 (3)

- November 2023 (3)

- October 2023 (3)

- September 2023 (1)

- August 2023 (2)

- July 2023 (2)

- June 2023 (1)

- May 2023 (1)

- April 2023 (2)

- March 2023 (1)

- February 2023 (1)

-pricing-structure.png?width=672&height=529&name=Typical-hardware-as-a-service-(HaaS)-pricing-structure.png)