Finance KPIs for hardware-as-a-service billing and collections

by Zachary Kimball on November 16, 2023

KPIs are critical for measuring and improving performance in finance. This is especially true for hardware-as-a-service (HaaS) companies, in which finance teams face a broader set of complexities than software companies or legacy hardware companies. Hardware-as-a-service metrics are more nuanced.

Accelerating cash flow with the right focus

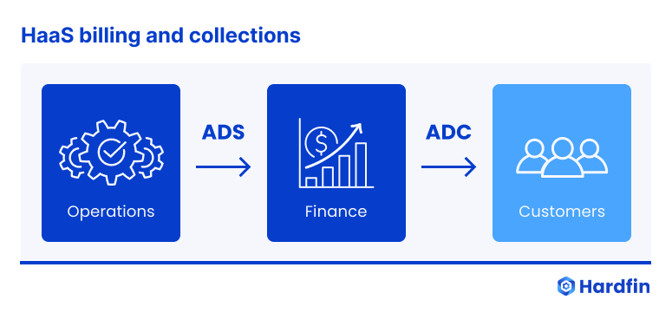

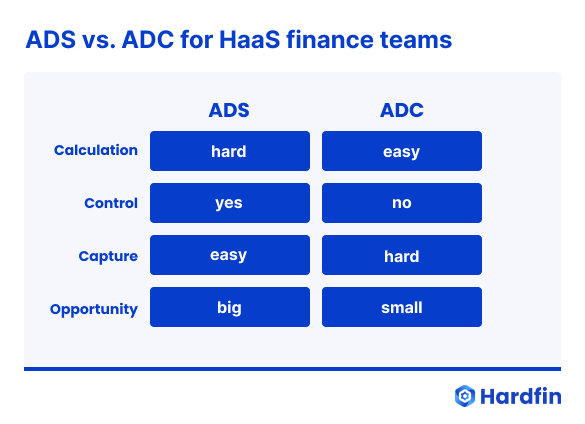

Finance teams at hardware companies need to pay attention to both average days to send (ADS) for billing and average days to collect (ADC) for collections. These are the two essential steps to turn assets into cash. Each of these critical metrics matters differently—and is easier or harder to calculate, to control, or to capture.

To improve cash flow and capture the biggest opportunity, HaaS finance teams—including accounts receivable (A/R) and collections—should usually focus on internal operations to reduce ADS. ADS is a harder metric to measure but is easier to manage, and is often a large opportunity for a company running a HaaS business model.

Many teams put energy into ADC, which emphasizes ensuring that customers pay on time. ADC is the easier metric to measure but it’s the harder metric to manage. Because it is harder to influence, it is often the smaller opportunity compared to ADS.

Internal operations and billing performance: Average days to send (ADS)

If you’re already measuring and optimizing average days to send, congratulations—you have a best-in-class finance team. ADS is generally the most important metric in hardware-as-a-service billing (and sister business models such as equipment-as-a-service, device-as-a-service, machine-as-a-service, and robots-as-a-service).

ADS is the average number of days it takes a company to send its invoices—a number that’s often quite high in HaaS organizations. Hardfin often sees ADS numbers approaching triple digits, since Finance may need data from inventory, shipping, operations, deployment, engineering, and elsewhere before they can put a single line item on an invoice. That data, which is based on real-world events, is difficult to track. Better tracking of fixed-asset data is often the biggest opportunity for finance teams to collect cash faster.

In fact, many HaaS companies can drive large reductions in asset-to-cash time—an improvement of 18x or more—through internal operations and reducing ADS. For every $1M of cash a company can pull forward by 90 days, it can generate around $35k in opportunity value from the cost of capital.

Accounts Receivable and collections performance: Average days to collect (ADC)

Many finance teams get tunnel vision measuring average days to collect (ADC), or the related metric days sales outstanding (DSO).

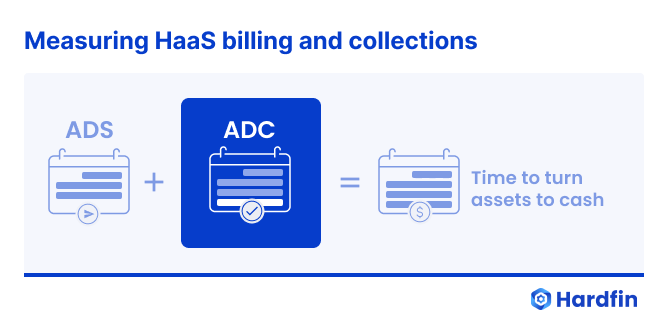

ADC is the average number of days it takes for invoices to be paid. It’s relevant for Accounts Receivable (A/R) and collections to understand actionable information about the business, because it provides a granular view of customer payment performance and collection efficiency. ADC helps you assess customer credit risk, benchmark your A/R performance, and optimize collection processes. To a lesser extent—certainly lesser than ADS—it supports improving cash-flow management.

Most finance teams focus on ADC because it’s a well-known metric, easy to track, and commonly used in SaaS. And indeed, you have to look at ADC if you want to operate a capable and efficient A/R team. But ADC is more difficult to optimize because it’s not in your control.

A company might spend thousands of dollars to optimize ADC by 10%—hiring a collections team to nudge customers to pay more quickly—and improve a 45-day ADC by less than 5 days. Meanwhile companies could automate asset tracking and billing management instead, improving ADS by 100 days. This distinction is what allows a HaaS business to achieve 3x faster time-to-cash using an integrated system for hardware financial operations. And it’s critical if HaaS makes sense for your business.

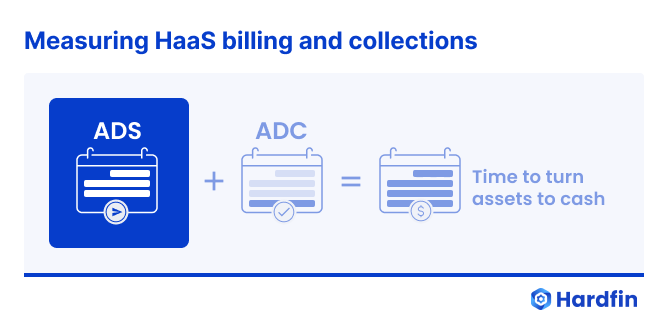

Measuring ADS and ADC

ADC is not complicated to measure: teams can run an A/R aging report or analyze invoice data. But SaaS invoicing software doesn’t calculate ADS. It’s possible to calculate ADS by manually calculating the time periods for every asset and line item:

- Time of real-world asset activity and when that activity is recorded

- Time from asset activity being recorded to when data is reported to Finance

- Time from Finance receiving data and then identifying that activity is billable

- Time from Finance identifying billable activity and invoicing the corresponding line item

This requires the ongoing cooperation of every department in a HaaS business, so it takes a lot of work and risks errors. A more efficient, less error-prone, and lower-cost option is to use integrated software that automatically measures these windows and reports opportunities to streamline performance.

The Hardfin platform knows whether it takes 1 day or 10 days for your Shipping department to report to your Finance team that devices have shipped. That’s because Hardfin natively links assets and billing so you can generate invoices immediately on asset activity, and turn assets into cash as quickly as possible.

We created Hardfin to help drive your ADS to zero. Want to start improving your hardware-as-a-service billing? Reach out to talk to one of our experts. We’d love to chat with you.

- HaaS (79)

- hardware as a service (78)

- haas100 (44)

- business model (10)

- billing (7)

- contract (4)

- equipment (4)

- RaaS (3)

- accounting (3)

- asset management (3)

- financing (3)

- operations (3)

- MSP (2)

- legal (2)

- managed service provider (2)

- revenue (2)

- robotics (2)

- robots-as-a-service (2)

- DaaS (1)

- MaaS (1)

- actions (1)

- assets (1)

- business model examples (1)

- device-as-a-service (1)

- eaas (1)

- equipment-as-a-service (1)

- finance (1)

- hardware financing (1)

- machine-as-a-service (1)

- metrics (1)

- pricing (1)

- product update (1)

- sales tax (1)

- solution definition (1)

- tax (1)

- February 2026 (2)

- January 2026 (3)

- December 2025 (1)

- November 2025 (2)

- October 2025 (2)

- September 2025 (2)

- August 2025 (3)

- July 2025 (3)

- June 2025 (2)

- May 2025 (2)

- April 2025 (2)

- March 2025 (4)

- February 2025 (4)

- January 2025 (3)

- December 2024 (3)

- November 2024 (2)

- October 2024 (2)

- September 2024 (3)

- August 2024 (2)

- July 2024 (2)

- June 2024 (2)

- May 2024 (1)

- April 2024 (2)

- February 2024 (3)

- January 2024 (3)

- December 2023 (3)

- November 2023 (3)

- October 2023 (3)

- September 2023 (1)

- August 2023 (2)

- July 2023 (2)

- June 2023 (1)

- May 2023 (1)

- April 2023 (2)

- March 2023 (1)

- February 2023 (1)