Financing options for modern hardware companies

by Zachary Kimball on January 31, 2024

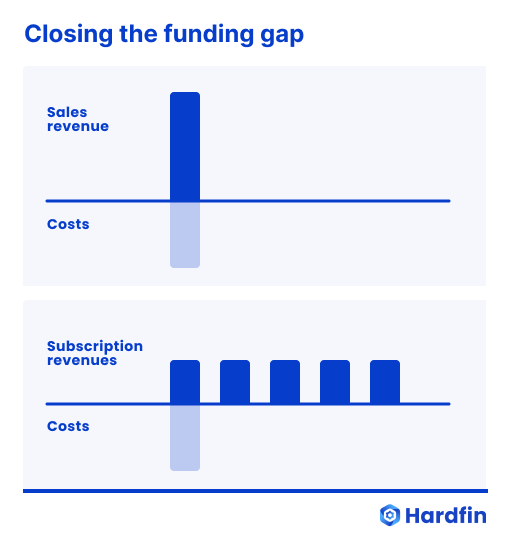

Finance leaders at hardware-as-service (HaaS) and equipment-as-a-service (EaaS) companies have complex jobs for many reasons. Among them is that HaaS and EaaS businesses have to cover the capital cost of each subscribed asset up front. This means not only the bill of materials (BOM), but also the rest of the cost of goods sold (COGS) for machines.

Manufacturers offering hardware subscription models make money over time to recoup their initial expenditures based on their hardware-as-a-service business model. This time period is called the “BOM payback period”—it is sometimes calculated based on fully loaded COGS if there are meaningful soft costs as part of deployment. Either way, the time delay means the company must “close the gap” in funding with cash-flow optimization strategies and financing options.

“Closing the gap”: the difficulty with HaaS and EaaS

High upfront costs coupled with smaller amounts of cash over time mean that hardware businesses transitioning to an as-a-service model are severely short on cash. Few companies are able to completely close the funding gap with customer payments. So most hardware companies end up seeking a financing option that is suitable for their business model.

For OEMs already selling hardware and looking at adopting a new as-a-service program (sometimes called “servitization” or “managed services”), this phenomenon is called “swallowing the fish” because the revenue and cost curves invert when a company shifts from device sales to a new hardware or equipment subscription. This “fish” problem is particularly surprising and unappealing to existing businesses used to seeing positive per-unit cash economics and gross margins every quarter!

In fact, the scaling motion for HaaS companies makes the funding gap even more drastic, because they are often selling to larger companies. The faster sales are ramping, the deeper the funding gap. And sales don't ramp in a linear fashion! When a large customer on a pilot suddenly wants to scale quickly to a large number of sites, the HaaS company is deeply "in the gap." Funding for device COGS can also be especially difficult for younger or emerging businesses because they have smaller balance sheets and less access to outside capital.

Of course, once the subscription model is operational, HaaS companies derive substantial benefits—increased customer loyalty, predictable recurring revenue, and higher profitability over time. Ultimately, hardware companies transitioning from upfront sales to an as-a-service model want to close the gap as scalably as possible.

This means that hardware companies must identify a financing model that helps them close the gap in line with their strategic goals. Companies can get cash from customers (get subscription prepayments), suppliers (finance equipment/parts acquisition), contract manufacturers (extend A/P terms), equity (raise capital), or financing institutions (find debt or lease financing). This article focuses on the latter—lending and leasing options.

HaaS and EaaS companies can choose from different models to fund BOM costs, and the model they choose will determine which capital provider they partner with. Each capital model has pros and cons, so it’s important to find the right partner for the unique solution.

Narrowing down financing options based on your hardware business model

There are four primary options for hardware financing and equipment debt. Two of these are more sales-oriented options (third-party equipment leasing and corporate bank debt) that support more traditional sales and some hybrid HaaS. And two are more subscription-oriented options (HaaS bank debt and sale-leaseback) that support hybrid and full subscription HaaS models.

Third-party equipment leasing provides financing directly to the end customer, giving the manufacturer capital up front. While corporate debt, HaaS debt, and sale leasebacks all provide financing directly to the manufacturer.

|

Sales |

⭤ |

Subscription |

||

|

Third-party equipment lease |

Corporate |

HaaS/EaaS |

Sale leaseback |

|

|

Legacy sales |

✅ |

Maybe |

❌ |

❌ |

|

Hybrid HaaS |

✅ |

Maybe |

Maybe |

❌ |

|

Full subscription |

❌ |

✅ |

✅ |

✅ |

The best option to consider should be based on the structure of the company’s hardware-as-a-service solution and the hardware-as-a-service business model being offered—whether it’s legacy sales, hybrid HaaS, or full subscription HaaS. For legacy sales and hybrid HaaS, third-party equipment leasing may make the most sense, though each model has at least one other financing option available. Full subscription hardware companies have achieved a fully modern business model, and they have three different financing options to support that model.

Comparing financing options for a subscription hardware business

Once you’ve identified the available financing possibilities for your business model, it’s time to find the right structure based on your assets, your as-a-service solution, any HaaS bundling choices, and your HaaS pricing model. Each option has tradeoffs to consider. An OEM should prioritize to balance short-term and long-term business priorities.

|

Sales |

⭤ |

Subscription |

||

|

Third-party equipment lease |

Corporate |

HaaS/EaaS |

Sale leaseback |

|

|

Equipment details |

||||

|

Types of equipment financed |

Least flexible (only recognizable equipment with a resale market) |

Very flexible (e.g., could be proprietary hardware) |

Very flexible (e.g., could be proprietary hardware) |

Mid-flexible |

|

HaaS company owns the assets? |

No |

Maybe (if full subscription) |

Maybe (if full subscription) |

No |

|

HaaS company can depreciate assets? |

No |

Yes (if service contract or operating lease) |

Yes (if service contract or operating lease) |

No |

|

Cash |

||||

|

Cash upfront |

Yes (at sale) |

When needed |

Yes (based on contract or deployment) |

Yes (at shipment) |

|

Cash coverage amount |

Retail price |

As needed |

BOM/COGS |

BOM/COGS |

|

Flexibility (can use the debt for things other than BOM/COGS) |

No |

Yes |

Maybe (depending on terms) |

No |

|

Costs |

||||

|

Cost to close |

None (paid by customer) |

Low (0–50 bps of commitment) |

Low (0–25 bps of commitment) |

None |

|

Ongoing cost |

None (paid by customer) |

Highest (higher principal payments) |

High (medium principal payments unless I/O) |

Medium (lowest principal payments) |

|

Long-term cost |

None (paid by customer) |

Medium (10–12%)1 |

Lowest (9–10%)1 |

High (15–20%)2 |

|

Convenience |

||||

|

Contract tenor (duration of facility) |

n/a |

Medium (2–3 years) |

Medium (2–3 years) |

Longest (usually 2–4 years, but 20+ years for very long-lived assets) |

|

Speed to close facility? |

Fast (referral) |

Slowest (4–6 weeks, due diligence) |

Slow (3–4 weeks, due diligence) |

Medium (1–2 weeks, light diligence) |

|

Speed to close each bank draw? |

n/a |

Easier (1–2 days with little/no documentation) |

Medium (3–5 days with some documentation) |

Slowest (5–10 days with detailed documentation) |

|

Speed to close each customer deal? |

Slow (1–4 weeks with customer documentation) |

n/a |

n/a |

n/s |

|

Risks |

||||

|

HaaS company accepts customer credit risk? |

No |

Maybe (if full subscription) |

Maybe (if full subscription) |

Yes |

|

HaaS company accepts interest-rate risk? |

No |

Maybe (if full subscription) |

Maybe (if full subscription) |

Yes |

HaaS financial operators can indeed think of these debt options as differently-shaped gaps: Some are easier to “close” upfront, but they’ll be less financially satisfying in the long run. Others will require a bigger “gap” upfront, but they’ll be more lucrative over the long term.

In other words, you’re essentially choosing financial discomfort now or down the road. If you can afford the discomfort now to get ongoing benefits later, that’s how you should prioritize your decision.

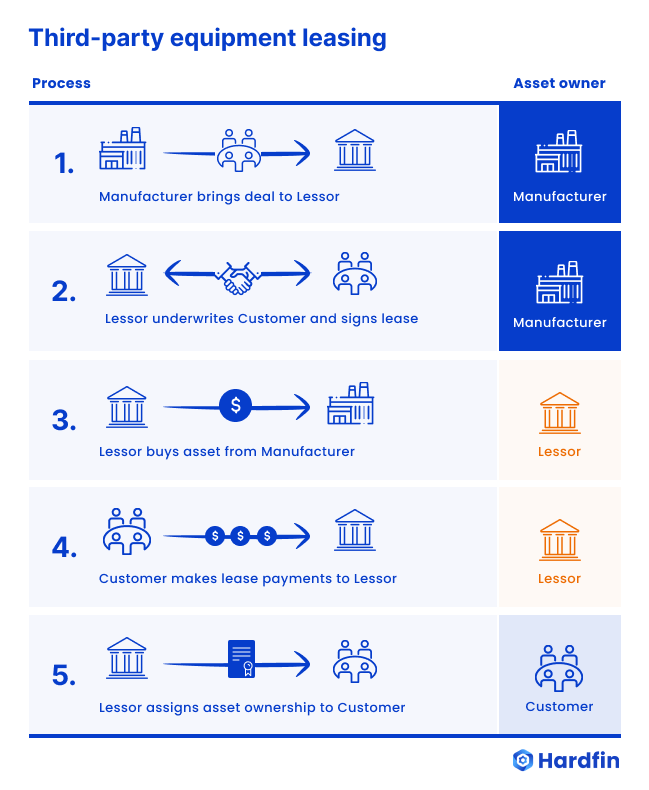

Option #1: Third–party equipment leasing

Third-party equipment lessors are the most classic legacy equipment lender. Equipment lessors buy the company’s hardware from the OEM at the agreed retail price. The lessor leases the asset to the customer directly, assuming responsibility for servicing (i.e., billing) and minimizing asset management for the HaaS company. Because it’s an outright equipment sale, this debt option isn’t for businesses offering full-subscription HaaS—it only works for legacy sales or hybrid models. And equipment lessors generally only deal with equipment for which there's a meaningful secondary marketplace (in case they need to resell the equipment in the future). So HaaS companies offering proprietary or unusual equipment won’t have access to this debt option—even if their model is legacy sales.

Equipment lessors are initially the lowest-cost option because the hardware company gets all the cash upfront, at the time of the deal. The lessor underwrites the end customer—looking at the customers’ financials, determining creditworthiness, and setting interest rates. (So while there is no explicit cost to the HaaS company, there can be a high cost to the customer in the form of lease rates.) The lessor then manages billing and payments with the customer. The upside for the HaaS company—in addition to the upfront cash infusion—is that it offloads credit risk to the lessor.

But the ongoing subscription is where things can get complicated: The lessor doesn’t maintain the hardware, and the HaaS company’s team are likely the experts on the equipment. So who pays for machine servicing? This model creates friction for the customer, who has to go through another party, share financials, get underwritten, and potentially receive invoices from two different parties (lessor for hardware, and HaaS company for software). While upfront cash is initially a boon, ultimately the HaaS company only receives smaller customer payments for the software subscription, rather than larger payments for the use of the equipment itself. So over time the HaaS company makes less revenue, and achieves a lower valuation than it would if it maintained ownership of the equipment.

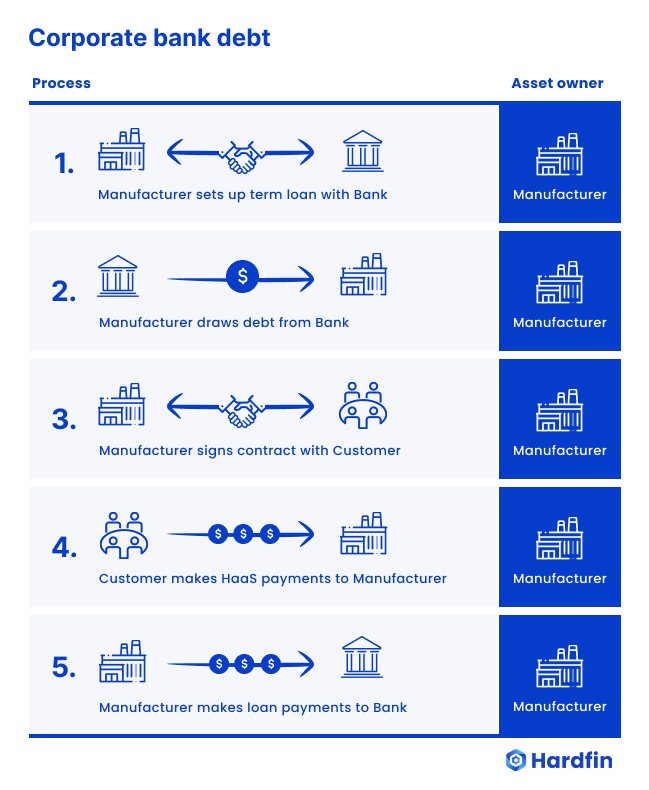

Option #2: Corporate bank debt

Corporate debt from banks is useful and practical for hardware-as-a-service and equipment-as-a-service companies. Unlike with third-party lessors, the hardware company can draw corporate debt well in advance of final production or sale. Equipment companies can use it to grow headcount, buy software, open a new factory, and more. For this reason, corporate debt is the most flexible solution for financing components and build costs very early on in asset production. Of course, the company must pay interest on those draws at a corporate debt rate.

In this case, the hardware company continues to own the asset from WIP/CIP to finished goods inventory. What’s more, the hardware company can offer a full-subscription model and continue to own the asset after the as-a-service program is active, while devices are out in the field with customers. Therefore, the company can depreciate each machine over time. As such, corporate debt allows a hardware company offering a full subscription model to match revenues and costs over time. This is powerful to preserve an intuitive gross margins story and maximize valuation.

Because the bank has a general lien on the business, rather than a specific lien on the equipment, hardware companies generally have unlimited flexibility about what types of equipment they can finance. So HaaS companies with proprietary hardware can take advantage of this debt type. However, because banks have less specific collateral, they are more skeptical about Haas companies’ credit risk before partnering—in other words, this may be more difficult debt to obtain. For startups, evaluating a corporate debt facility can be daunting.

It is important to note that corporate debt can have a wide range of interest rates and terms. This is based largely on the scale of the company and on the structure of the debt. Corporate debt can be expensive and flexible (typical for debt products for early-stage companies) or much more restrictive but very inexpensive (typical for late-stage or public companies).

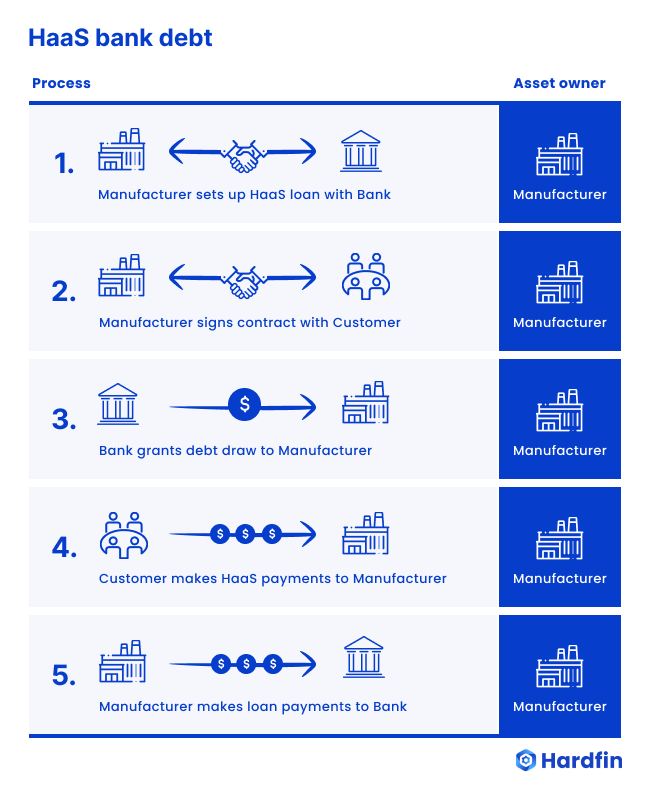

Option #3: HaaS bank debt

HaaS bank debt is another bank debt option that is particularly well suited for hardware-as-a-service and equipment-as-a-service companies. In this model, the hardware company gets cash based on an asset-related milestone. The particular milestone varies based on the business and the loan—usually either when devices are built, contracts are signed, or devices are deployed.

So this is more restrictive than general corporate debt. The HaaS company’s ability to draw on the debt will be related to its asset activity or related contracts. However, while HaaS debt usually restricts draws to specific milestones related to assets (i.e., the debt is asset-linked), the draws usually do not place specific liens on those assets (i.e., the debt is not asset-backed). However, as with corporate debt, there is a general lien on the business. And as with corporate bank debt, the hardware company continues to pay interest on each draw. If the HaaS company offers a full subscription model, they continue to own and depreciate the asset.

Usually, because of the more restrictive asset-linked nature of the advances, interest is a bit lower for HaaS debt. In fact, long-term costs on this debt are lower than for all other loan types. And as with corporate bank debt, the bank will be flexible about the type of equipment it finances—it could fund unique or proprietary hardware. And the debt isn’t strictly for funding the BOM: these funds can often be used to cover fully-loaded COGS including overhead and installation costs.

Banks often hold a high bar about a company’s credit risk before partnering on HaaS debt. The upfront costs of this debt are usually a bit lower than corporate debt but a bit higher than a sale leaseback.

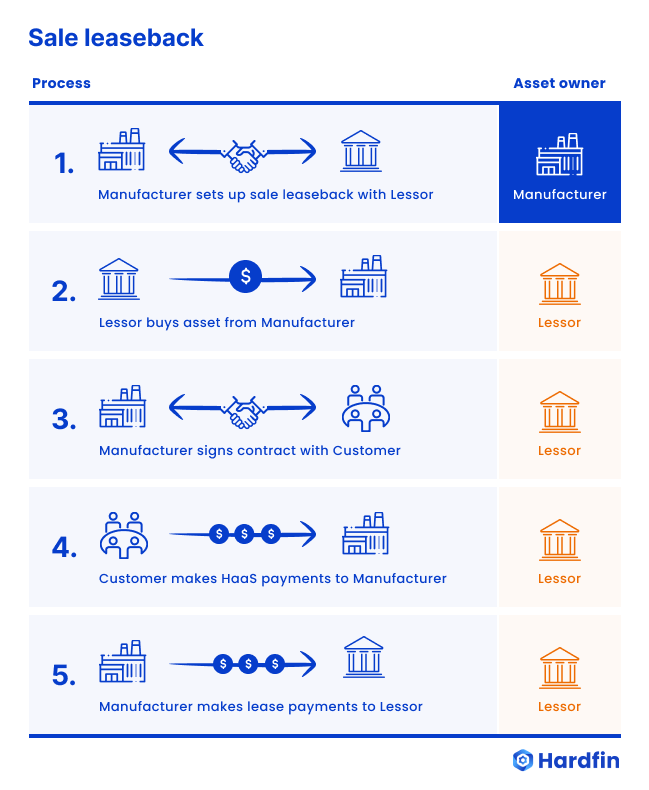

Option #4: Sale leaseback

In a sale leaseback (SLB) model, the HaaS company sells its hardware directly to the financier. The HaaS company then pays a lease fee to the SLB firm and leases the asset to the customer with a margin for software (and other services) on top, realizing the difference.

Among the advantages of this debt model are that the hardware company gets cash upfront, so the short-term cost is lower because the asset has been sold and the HaaS company is only paying operating lease fees on it. What’s more, an SLB firm will likely be easier to get debt from than a bank because they then own the hardware—which means less risk for them, as well as the tax advantages of the associated depreciation.

But of course the flipside for the HaaS company is that it no longer owns the asset and so cannot depreciate it. What’s more, once the lease is up, the HaaS company is no longer in control of the hardware. The SLB firm wants to re-lease it—they’re not in the business of operating assets—but ultimately they have control of the equipment and thus effective control over the negotiation of a new lease term.

An SLB provider will directly influence the HaaS company’s ongoing costs even beyond the initial term of the lease, so there’s a known risk. Ultimately, while the short-term cost of this debt option is lower, and medium-term payments are often lower as well, over the long term SLB becomes more expensive because the hardware company has to renew the leases on its own productive assets, and cannot take advantage of depreciation.

What about venture debt?

Venture debt refers to a type of corporate debt offered to startups. The key differences between “vanilla” corporate debt and venture debt are: (1) venture debt is accessible to earlier-stage businesses, including unprofitable startups,3 (2) venture debt lenders look seriously at the company’s venture investors to evaluate risk, as opposed to focusing more on the P&L and balance sheet, and (3) venture debt deals include stock warrants on the business to compensate for the additional risk.

Venture debt is available and relatively cheap, but only to a subset of companies (i.e., startups). For those companies, venture debt is particularly attractive because the cost of capital is much lower than the cost of equity capital, even after taking warrant grants into account.

Both corporate debt and HaaS debt can include flavors of venture debt, depending on the borrowing entity. That is, if a startup is looking for corporate debt, they should be looking for corporate venture debt. If a startup is looking for HaaS debt, they should be looking for HaaS venture debt. Venture debt itself (including warrants) will be a bit more expensive than corporate debt, and venture HaaS debt (with warrants) will be a bit more expensive than HaaS debt.

What about debt funds and private credit?

Another option that has become increasingly prevalent over the last few years comes from private debt funds (aka “debt funds” aka “private credit”).4 These funds are private entities that can extend credit much more flexibly than banks, but expect higher rates of return. So there are many more options from private debt funds—larger facilities, more flexible draw terms, general or asset-backed options, different ownership structures, asset pooling, and more. But a company should expect to pay a debt fund ~3x compared to a vanilla corporate debt deal.

What about asset-backed securities?

Asset-backed securities (ABS) are an option only for large and stable hardware companies that can bundle and sell large amounts of device-based receivables. Companies can consider investigating these options when they are able to offer $100M+ of subscription contract value in a vintage. But ABS are expensive to structure and place, so the ABS market truly becomes economical when an issuer can offer $250M+ in a single placement.

Deciding which financing option is best for your business model

Finance leaders determining which option to pursue should ask themselves these questions:

- Which business model supports our long-term strategy? Which financing options best support that model?

- How important is it for our model that we continue to own and depreciate the assets? How does the shape of our expenses impact our financial story?

- What do short- and medium-term financials look like? How badly do we need cash upfront?

- What’s our short- vs. long-term operating tradeoff? How important is it to maximize long-term margins?

- How proprietary is our solution and which financiers will be willing to support it?

- Do we primarily need to fund BOM/COGS only, or do we need cash for other business investments?

It’s essential to find a good financial partner if you want to “close the gap” and scale hardware subscriptions. At Hardfin, our experts can answer questions you have about transitioning to a subscription model, and the financing options that are right for your business.

Note: our team does not offer capital. We are a software business. The Hardfin platform empowers HaaS companies to capture more revenue and convert assets to cash faster through automation. That makes it easy to provide your financial partners with the right data and metrics. We are happy to make relevant introductions to financiers.

| As HaaS business models evolve, software is evolving to support it. Modern hardware companies use Hardfin to manage, operate, and report on financial operations. | ||

| ⚠️ | Disclaimer. This is not accounting, tax, or legal advice. We share our perspective based on work with finance teams across the hardware industry, but it is not intended to guide every case. For a deeper assessment of your own situation, get in touch and we can connect you with the right professionals. | ||

-

These estimates are approximate based on prevailing market interest rates in January 2024. Most debt facilities are based on a floating or adjusting interest rate such as LIBOR or WSJ Prime, so they can vary considerably over time and during the life of the facility. Some debt instruments (particularly venture debt) also include stock warrants, which add to the overall cost of the facility.

-

These estimates are approximate based on fully-loaded interest costs in January 2024. Sale-leaseback pricing is based on a lease rate factor, which includes the capitalized cost being funded and a residual value calculation, relative to the lease term. Lease prices are based on market interest rates, so they can vary considerably over time but are usually fixed during the life of the lease.

-

Because both venture-backed startups and venture-capital investors are heavily focused on valuation, it is very common and important for hardware startups to emphasize a recurring-revenue model through hybrid HaaS or full subscription HaaS.

-

There is growing concern that private debt funds have overextended credit and there is a coming crisis in the private credit market.

- HaaS (78)

- hardware as a service (77)

- haas100 (43)

- business model (10)

- billing (7)

- contract (4)

- equipment (4)

- RaaS (3)

- accounting (3)

- asset management (3)

- financing (3)

- operations (3)

- MSP (2)

- legal (2)

- managed service provider (2)

- revenue (2)

- robotics (2)

- robots-as-a-service (2)

- DaaS (1)

- MaaS (1)

- actions (1)

- assets (1)

- business model examples (1)

- device-as-a-service (1)

- eaas (1)

- equipment-as-a-service (1)

- finance (1)

- hardware financing (1)

- machine-as-a-service (1)

- metrics (1)

- pricing (1)

- product update (1)

- sales tax (1)

- solution definition (1)

- tax (1)

- February 2026 (1)

- January 2026 (3)

- December 2025 (1)

- November 2025 (2)

- October 2025 (2)

- September 2025 (2)

- August 2025 (3)

- July 2025 (3)

- June 2025 (2)

- May 2025 (2)

- April 2025 (2)

- March 2025 (4)

- February 2025 (4)

- January 2025 (3)

- December 2024 (3)

- November 2024 (2)

- October 2024 (2)

- September 2024 (3)

- August 2024 (2)

- July 2024 (2)

- June 2024 (2)

- May 2024 (1)

- April 2024 (2)

- February 2024 (3)

- January 2024 (3)

- December 2023 (3)

- November 2023 (3)

- October 2023 (3)

- September 2023 (1)

- August 2023 (2)

- July 2023 (2)

- June 2023 (1)

- May 2023 (1)

- April 2023 (2)

- March 2023 (1)

- February 2023 (1)