‘Closing the gap’ in HaaS: investing upfront for recurring revenue

by Zachary Kimball on December 20, 2023

Several factors are driving a rise in as-a-service business models for hardware, and the sister models of equipment-as-a-service, device-as-a-service, and machine-as-a-service.1 A subscription-based service model can be vastly more successful than a sales model. The biggest outcomes of hardware-as-a-service (HaaS) are increased customer loyalty, predictable recurring revenue, and higher profitability over time. There are a number of hardware-as-a-service (HaaS) business models that can help achieve these results.

The benefits eventually outweigh the costs, but the operational challenges of HaaS can be very difficult for hardware companies. Finance teams in particular face unique difficulties with HaaS and are sometimes reluctant or uncertain how to embrace hardware subscriptions. That’s especially true because HaaS—selling hardware subscriptions rather than assets—demands a new financing model.

The enormous opportunity and huge challenge of HaaS

The fundamental challenge of HaaS businesses is that they have to support the financial costs of building hardware upfront, but those costs are paid back over time. Because of these capital needs, HaaS businesses cannot support unconstrained growth in the same way that SaaS companies can.

Traditional hardware companies that sell assets have the advantage of collecting cash immediately. Adopting HaaS means less upfront cash collection while subscription fees replace sizable sales. So HaaS businesses are underwater for the first few quarters or years. They also have to make investments in the operating capabilities required for a successful subscription-based offering.

Take an example: A hardware business called Midsize Machinery (MM) that offers a machine with a 5-year life that costs $100,000 to build.

- In the past, MM sold the machine outright for $160,000 (a 37.5% margin). Gross profit for each piece of equipment is $60,000.

- In the future, MM will launch a cloud platform that enables the machine to drive itself! They charge $60,000/year for customers to use the machine on a hardware subscription. MM’s lifetime revenue for this contract is $300,000 (a 60% margin) and their gross profit per device has gone up to $200,000 – a 233% increase in GP dollars!

- The company sold 100 units last year and will offer 100 units on the new subscription program.

Seems pretty great! MM has discovered an incredibly profitable business model transition to turn 100 assets from $6M of profit into $20M instead.2

| Past | Future | Change | |

| Device cost | $100,000 | $100,000 | – |

| Upfront price | $160,000 | – | stop legacy model |

| Annual price | – | 5 x $60,000 | adopt new model |

| Total contract value | $160,000 | $300,000 | +88% |

| Gross profit (GP) | $60,000 | $200,000 | +233% |

| GP margin | 38% | 67% | +78% |

What's more, investors like the subscription model better. So while the market values a one-time sales model with 40% gross margins around 4–5x EBITDA, a recurring-revenue business at 70% gross margins is more likely to be valued around 8–10x revenue.

Assume the company has $3 million of SG&A cost for this 100-unit business. If MM could capture all this subscription revenue right away, it would change its financial position from a sales company worth $12–15 million into a subscription company worth $136–170 million. This is financial alchemy.3

| Past | Future | Change | |

| Revenue | $16M | $30M | – |

| Gross profit | $6M | $20M | +233% |

| SG&A | $3M | $3M | – |

| EBITDA | $3M | $17M | +467% |

| Valuation estimate | 4–5x EBITDA | 8–10x revenue | – |

| Company valuation | $12–15M | $136-170M | +1,033% |

Of course there's a catch: MM doesn't capture all the revenue up front. But they do have to pay the costs. The problem is, for every 100 subscription units, MM is running a $4M deficit in the first year. It takes until year 2 just to break even. It’s not until year 3 that MM has netted more in profit than the sales model. Fixing this problem is “closing the gap” in HaaS.

Breaking down the example

If there's even a shred of hope for Midsize Machinery (MM) to make this story a reality, it's worth an investigation. MM looks at how this breaks down over time.

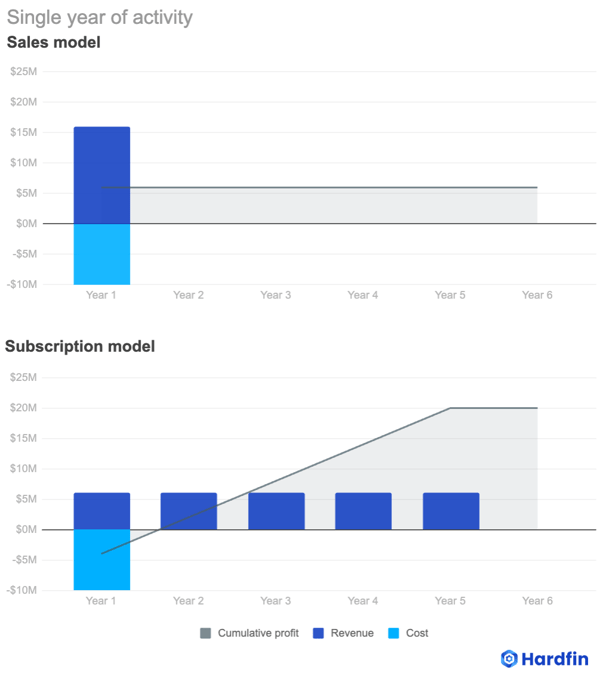

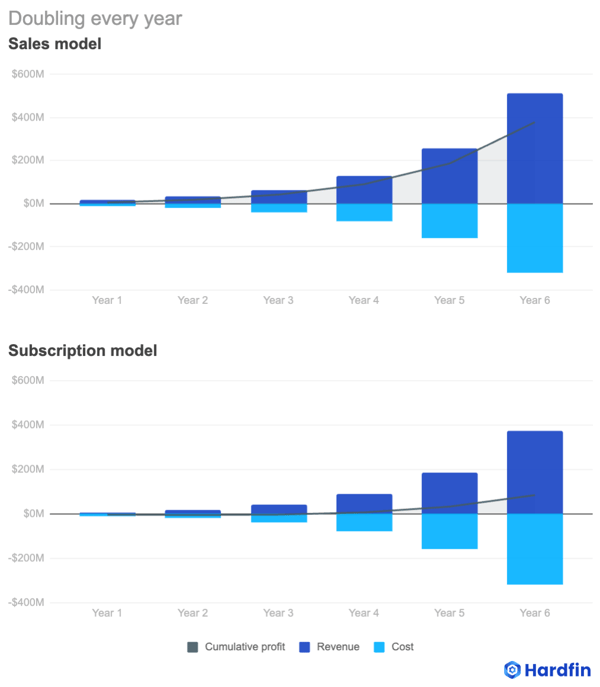

Starting with that first year of the subscription model, MM is running a $4M deficit. In year 2 they break even. And in year 3 MM nets more in subscription profit than the sales model. It took three years to “close the gap” with profits from this model:

Of course, MM wants to keep doing business. In the past, selling 100 units per year would generate $6M in profit every year. Now subscribing 100 units every year, the cash trouble gets worse.

MM doesn’t break even until year 3. It’s not until year 4 that MM has netted more in profit from the HaaS model than the sales model. It took four years to “close the gap” with profits from this model:

So HaaS can be a wildly better business model than hardware sales but that there is a fundamental funding problem that HaaS businesses have to solve. For most businesses, the faster they grow the better they do. With HaaS, it’s the opposite – for a little while.

The relationship between growth rate and financing need for a HaaS business

The more quickly a HaaS organization scales, the deeper the funding problem. The company has to “close the gap” for every unit that goes out the door. In other words, if an organization has a consistent deployment of assets over time, it catches up to close the gap eventually. But when rapidly accelerating deployments, a company is always spending more than it’s bringing in.

This is not a unit-economics problem. This is not a joke that “we lose money on every sale, but make it up in volume.” In fact, every HaaS unit can be wildly profitable over its lifetime, and the HaaS business can be growing rapidly, but the HaaS company will still face an existential capital crisis.

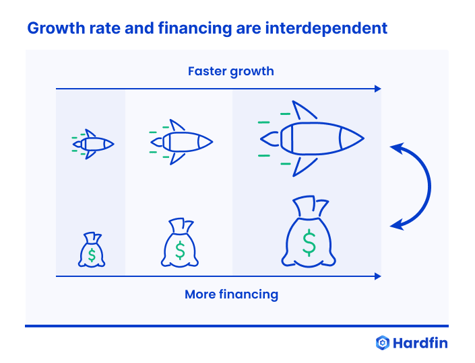

Take our friends at Midsize Machinery (MM). With a constant number of units, they discovered it would take the subscription model three years to break even and four years to “close the gap” with hardware sales.

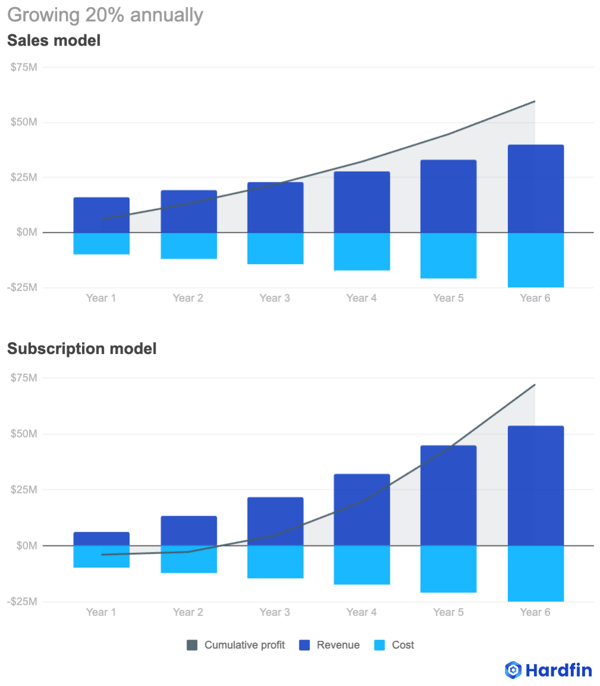

What if MM can achieve a 20% annual growth rate? Selling hardware, they’ll be driving an increasing amount of profit. With HaaS, it still takes until year 3 to break even and now takes until year 5 to match the sales model. By year 6 they are generating almost TWICE the annual gross profit but it took five years to “close the gap” with profits from this model:

This is where things really shine for HaaS. At a high growth rate after five years, MM is consistently generating higher revenue at higher margins than a sales-based business. They've made it! This is the reason that HaaS companies are more successful in the long run.

Everything breaks with hypergrowth. If MM is able to double its volume every year, sales profits are up and to the right. But this extreme example looks very different with subscriptions.

On a recurring model with a 100% growth rate, it takes until year 4 to break even. As long as MM is deploying 2x as many units every year, profitability will never catch up. It takes 20 months to break even on each unit, so new machine build costs are outpacing subscription revenues too quickly. The company cannot “close the gap” with profits from this model:

This is where HaaS fundamentally differs from SaaS: hardware companies can’t support uninhibited growth the same way software companies can.

However, all is not lost—these contracts are still delivering extremely profitable unit economics. There are options for device-as-a-service businesses to fund their asset costs while delivering profitable unit economics and still scaling rapidly. In some case, hardware companies may have greater access to these options than software companies.

Strategies for closing the gap and mitigating cash needs

It's clear that a HaaS company’s need for cash is directly proportional to its growth rate. So finance teams at hardware companies offering an as-a-service model naturally face a lot of pressure to accelerate cash payments, above and beyond the accounting complexity of administering the HaaS model.

Aside from raising equity capital or slowing down growth—which may both be used from time to time as strategies to bridge the gap—what other options are there? These break down into four areas.

Contract structures

Here are a few common ways to set contractual payment terms to pull cash forward:

- Annual or quarterly payments (to accelerate cash collection)

- Prepayment for some period (typically 6–12 months of a multi-year contract)

- Down payments (typically for a defined percentage of the contract)

These payment terms are different than constraints about setting contractual start dates for HaaS.

Pricing levers

Here are a few common ways to structure HaaS pricing plans and set up bundled HaaS offerings to maximize cash:

- “Standard” prepaid items (such as installation fees or shipping charges)

- “Optional” prepaid items (usually a service plan or a warranty program)

- Prepayment discounts (usually a 10–20% discount to pull cash forward)

Cash collection

Here are a few common ways to track cash collection and improve billing performance to pull cash forward:

- Reduce average days to send (get invoices out the door faster)

- Monitor average days to collect (make sure customers pay on time)

- Use automated software (to manage the financial complexity)

Financing providers

If you’re scaling rapidly with HaaS you’ll ultimately have to look to a financing provider for support. This is especially true for younger or emerging businesses that have smaller balance sheets and less access to outside capital.

Fast-growing HaaS companies can choose to work with any number of capital providers that offer different financial models:

- Corporate bank debt (classic debt option against the company)

- Asset-backed lending (requires meaningful scale to engage)

- Venture debt (to support fast-growth businesses)

- HaaS bank debt (a custom debt instrument designed for HaaS)

- Sale-leaseback (more accessible but with less control)

Different models are generally available depending on your HaaS business model. Each type of provider has pros and cons, so you’ll want to find the right partner for your unique assets and the structure of your HaaS solution.

Software to help close the gap

Inevitably, HaaS companies spend more money building hardware than they’ll collect in invoicing for a period of time—potentially a long period of time. That’s one reason it’s critical to monitor HaaS finance and collections KPIs closely, and to ensure that HaaS billing is managed effectively.

Once a HaaS model is scaled up, equipment-as-a-service companies reap a world of benefits: digital transformation, increased efficiency, increased revenue and profits, and deep customer loyalty. Indeed, for businesses executing the transition to a subscription-based service, their new model will be vastly more successful than their legacy model.

Automated software is the best way for HaaS companies to minimize the time it takes to go from assets to revenue. The Hardfin platform lets you take charge of your hardware financial operations. Our experts can support any questions you have about accelerating your subscription model.

| As HaaS business models evolve, software is evolving to support it. Modern hardware companies use Hardfin to manage, operate, and report on financial operations. | ||

1. Some companies and publications refer to an even broader umbrella model of anything-as-a-service, everything-as-a-service, or X-as-a-service (XaaS).

2. For equipment businesses that have offered hardware sales and are now shifting to HaaS, this phenomenon is sometimes called “swallowing the fish” because the revenue and cost curves invert when launching a new hardware subscription. Ultimately, a HaaS company’s goal is to “get through” the middle part of the fish as efficiently as it can, so that revenue and profits are outpace expenses as soon as possible. This simple example doesn’t account for the ongoing support costs, although these are usually negligible relative to hardware COGS and the additional gross profit opportunity.

3. Of course a wildly simplified example to make the point. Even with a big haircut, there is a meaningful difference between how sales and subscription business are valued.

- HaaS (79)

- hardware as a service (78)

- haas100 (44)

- business model (10)

- billing (7)

- contract (4)

- equipment (4)

- RaaS (3)

- accounting (3)

- asset management (3)

- financing (3)

- operations (3)

- MSP (2)

- legal (2)

- managed service provider (2)

- revenue (2)

- robotics (2)

- robots-as-a-service (2)

- DaaS (1)

- MaaS (1)

- actions (1)

- assets (1)

- business model examples (1)

- device-as-a-service (1)

- eaas (1)

- equipment-as-a-service (1)

- finance (1)

- hardware financing (1)

- machine-as-a-service (1)

- metrics (1)

- pricing (1)

- product update (1)

- sales tax (1)

- solution definition (1)

- tax (1)

- February 2026 (2)

- January 2026 (3)

- December 2025 (1)

- November 2025 (2)

- October 2025 (2)

- September 2025 (2)

- August 2025 (3)

- July 2025 (3)

- June 2025 (2)

- May 2025 (2)

- April 2025 (2)

- March 2025 (4)

- February 2025 (4)

- January 2025 (3)

- December 2024 (3)

- November 2024 (2)

- October 2024 (2)

- September 2024 (3)

- August 2024 (2)

- July 2024 (2)

- June 2024 (2)

- May 2024 (1)

- April 2024 (2)

- February 2024 (3)

- January 2024 (3)

- December 2023 (3)

- November 2023 (3)

- October 2023 (3)

- September 2023 (1)

- August 2023 (2)

- July 2023 (2)

- June 2023 (1)

- May 2023 (1)

- April 2023 (2)

- March 2023 (1)

- February 2023 (1)