How to structure a HaaS contract for recurring revenue

by Zachary Kimball on January 11, 2024

Hardware-as-a-service (HaaS) is the future of different hardware sales models. There are good reasons that subscription models are growing in popularity: HaaS builds deeper relationships with customers, creates opportunities to offer more value to an existing customer base, and creates a recurring revenue business. Because recurring revenue is stronger and more predictable, investors prefer these businesses—ultimately leading to higher valuations over the long term.

So for a hardware company, recurring revenue is the biggest advantage of an effective hardware-as-a-service solution. This isn’t possible with outright sales, so companies turn to managed services models. This value starts whether a device company transitions to a hybrid recurring sales model, or operates a full subscription sales model—either way, the business is on its way to maximizing its valuation.

Unfortunately, accounting rules can trip up these business goals. Accounting rules make it tricky get recurring revenue treatment for hardware. So multiple functions must coordinate—from Sales, Finance, Accounting and Legal—to make sure that equipment-as-a-service contracts have exactly the right terms.

The risks of treating assets the wrong way in contracts

Treating assets the “wrong” way in contracts can be a disaster for a hardware business. Sales and Finance teams can go the distance in designing a subscription program to drive recurring revenue, and end up putting the entire business at risk—possibly missing out on ARR for every hardware contract.

Auditors look to the contract to decide how the manufacturer should recognize revenue. If the right “do’s and don’ts” aren’t considered, the contract will result in one-time revenue, usually because the contract ends up treated as a capital lease. The accounting standards are complex but hardware-as-a-service companies usually want to avoid lease treatment altogether, or, failing that, need to achieve operating lease treatment instead.

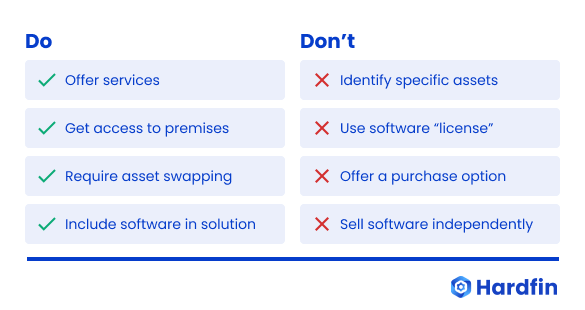

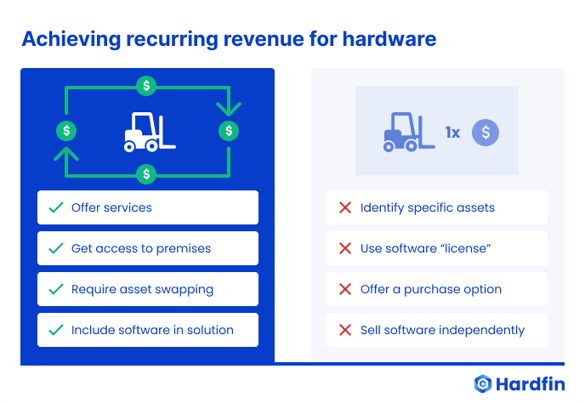

When a manufacturer has to treat the contract like a sale, revenue is recognized for the machines on day one. This directly impacts financial statements, keeps HaaS companies from experiencing the benefits of recurring revenue, and makes them less appealing to investors. There are four essential “do’s” and four essential “don’ts” for any hardware company that wants recurring revenue:

Here are the details to consider to ensure the assets in a hardware business get recurring revenue treatment (instead of revenue being recognized up-front at the beginning of the contract):

Four HaaS contract “do’s” to drive recurring revenue

- DO offer the services of the asset—not the asset itself. Offering a service is the opposite of selling hardware: In a HaaS contract, ownership must stay with the hardware company. Explicitly describe this as a services agreement for the output of any assets.

Ex: “At various times to deliver on its service commitments, Manufacturer may deliver assets to varying locations at its sole and complete discretion. In such cases, Manufacturer will provide only the services equivalent to each asset. Customer payments under this Agreement do not create, transfer, or convey title to any such assets; and the delivery of such assets by Manufacturer does not imply any transfer of title to Customer, or vest any right in Customer, of such assets.” - DO get explicit access to the premises to get to the asset. As the owner of the asset, the manufacturer should have access to the hardware whenever they need it—whether for repairs, swapping parts, or any other reason.

Ex: “Manufacturer shall have free access to any assets on Customer’s premises. In the event of an emergency, Manufacturer, its agents or employees shall have immediate access without notice. For all other purposes, Manufacturer shall have access during business hours or with 24 hours notice.” - DO require that you can swap out assets at any time for any reason—or for no reason at all. This follows from asset access: whether for maintenance, upgrades, or simply the manufacturer’s convenience, contracts must allow the manufacturer to change out hardware devices whenever they choose.

Ex: “All intellectual, industrial, or other title and property rights in and to any asset, including its design, configuration, components, hardware, and software, and all innovations and derivative works based in whole or part on any of the same, are and will remain the exclusive property of Manufacturer. Manufacturer reserves the right to exchange, reassign, trade, or swap any assets on Customer’s premises for any reason, or for no reason at all.” - DO include software as part of a single HaaS solution. Software should be part and parcel of the services package, as opposed to an enabler for hardware (especially hardware sold separately). Contracts can ideally bundle that software as part of a broader solution, to ensure that the “services” nature of the contract is clear.

Ex: "Manufacturer will provide the applicable Services to Customer in accordance with the terms and conditions set forth in this Agreement. Subject to Customer’s compliance with the terms and conditions of this Agreement, Manufacturer hereby grants to Customer a limited, non-exclusive, non-transferable right to use the Services during the applicable Term.”

Four HaaS contract “don’ts” to drive recurring revenue

- DON’T identify a specific asset (by serial number or otherwise). Manufacturers should not be locked in to provide identified assets for a specific customer. Identifying the asset (e.g., “S/N 1234”) trips the equipment leasing guidance under the accounting standards codification. Remember: this isn’t a contract for a machine; it’s a contract for services that are delivered partially by equipment. The simplest way for a hardware company to achieve recurring revenue treatment is to ensure the contract provides services. There may be any asset, or some assets—but never a specific asset.

- DON’T offer a purchase option on the asset. The manufacturer delivers the value of the services provided by the hardware, never the device itself. Providing an option to purchase equipment complicates the services question, and is likely to negate recurring revenue treatment by classifying the equipment under a capital lease.

- DON’T use the word “license” to refer to software. A “license” for software is itself more likely to be treated as a capital lease, which prevents manufacturers from seeing recurring revenue. Instead of “software license,” a Manufacturer might offer “software services” or a “cloud platform subscription” or “software access fees.”

- DON’T sell software independently from devices. When sold separately from hardware, software is more likely to be treated as an independent performance obligation in the contract, rather than part of a "series" or bundle. This is especially true when a separately billed software item is sold with only some, but not all, contracts.

Why this matters for recurring revenue treatment in HaaS

Where do the “do’s and don’ts” come from? Your contract structure has critical implications for how your business recognizes revenue. The core accounting determinations for HaaS are (1) whether your contract includes a lease, (2) how much of your contract is a lease, and (3) what kind of lease it is. This in turn feeds into how your revenue is recognized under the accounting standard. Modern hardware companies want to drive recurring revenue over time for both the predictability and valuation benefits.

Businesses can easily and unintentionally classify their revenue under capital lease provisions (e.g., by offering a buyout provision). In these unfortunate cases, the business needs to recognize all its revenue up front. The company did so much work to develop HaaS pricing plans, build a compelling HaaS bundle, and manage recurring HaaS billing… but suddenly the business is back to square one! Revenue is recognized at the beginning of the contract—just like a one-time sale. HaaS companies must be careful to avoid this.

In contrast, a services agreement or operating lease is much more desirable because those arrangements allow recurring-revenue treatment over the life of the contract. This means more predictable revenue numbers quarter-over-quarter, and it means higher valuations from investors. This is the goal for modern hardware companies.

Want to know more about best practices for your HaaS contracts, or about streamlining your hardware financial operations to turn your assets into recurring revenue? Reach out to talk to one of our experts. We’d love to chat with you.

| As HaaS business models evolve, software is evolving to support it. Modern hardware companies use Hardfin to manage, operate, and report on financial operations. | ||

| ⚠️ | Disclaimer. This is not accounting, tax, or legal advice. We share our perspective based on work with finance teams across the hardware industry, but it is not intended to guide every case. For a deeper assessment of your own situation, get in touch and we can connect you with the right professionals. | ||

- HaaS (78)

- hardware as a service (77)

- haas100 (43)

- business model (10)

- billing (7)

- contract (4)

- equipment (4)

- RaaS (3)

- accounting (3)

- asset management (3)

- financing (3)

- operations (3)

- MSP (2)

- legal (2)

- managed service provider (2)

- revenue (2)

- robotics (2)

- robots-as-a-service (2)

- DaaS (1)

- MaaS (1)

- actions (1)

- assets (1)

- business model examples (1)

- device-as-a-service (1)

- eaas (1)

- equipment-as-a-service (1)

- finance (1)

- hardware financing (1)

- machine-as-a-service (1)

- metrics (1)

- pricing (1)

- product update (1)

- sales tax (1)

- solution definition (1)

- tax (1)

- February 2026 (1)

- January 2026 (3)

- December 2025 (1)

- November 2025 (2)

- October 2025 (2)

- September 2025 (2)

- August 2025 (3)

- July 2025 (3)

- June 2025 (2)

- May 2025 (2)

- April 2025 (2)

- March 2025 (4)

- February 2025 (4)

- January 2025 (3)

- December 2024 (3)

- November 2024 (2)

- October 2024 (2)

- September 2024 (3)

- August 2024 (2)

- July 2024 (2)

- June 2024 (2)

- May 2024 (1)

- April 2024 (2)

- February 2024 (3)

- January 2024 (3)

- December 2023 (3)

- November 2023 (3)

- October 2023 (3)

- September 2023 (1)

- August 2023 (2)

- July 2023 (2)

- June 2023 (1)

- May 2023 (1)

- April 2023 (2)

- March 2023 (1)

- February 2023 (1)